LONMIN confirmed it was cutting jobs in order to protect its operations against sustained low platinum group metal (PGM) prices and increasing cost pressures.

Reuters reported earlier today, citing the union Solidarity, that some 1,000 jobs were at risk. Lonmin spokeswoman, Wendy Tlou, said the figure included contractors. In terms of permanent employees up to 446 jobs, equal to 1.8% of the total workforce, were at risk.

“Lonmin confirms that it has begun a consultation process under sections 189 and 189(A) of the Labour Relations Act as part of its effort to ensure the sustainability and prospects of the company,” it said in a statement after the market had closed on October 23.

“Increasing cost pressures and the persistently low PGM prices make it necessary for Lonmin and its sector peers to consider additional measures in the interests of all stakeholders,” it added.

“The announcement of a S189 process is part of a review of Lonmin’s operations intended to protect employment of the majority of the workforce, improve efficiencies, streamline the business and optimise cash generation and favourably position the company to take advantage of any future improvements in the platinum industry,” it said.

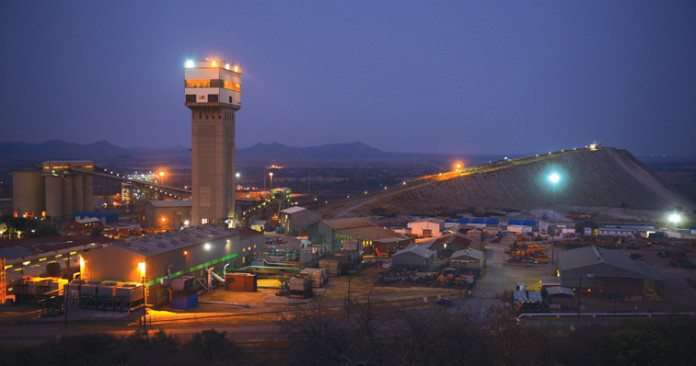

This will bring to over 8,000 the number of jobs reduced at Lonmin’s shafts in Rustenburg over the last two years and provides some insight into how the UK-listed company is struggling to survive notwithstanding recent improvements in its net cash levels.

Lonmin cut about 6,860 jobs in its 2016 financial year taking down its full staff numbers to just over 33,000 souls. Then several months later it cut into its production target of about 700,000 ounces to about 650,000 to 680,000 oz for the 2017 financial year.

Development crews were redeployed and contractors were reintroduced into the Generation One shafts, the older parts of the Marikana complex, in order to lift volume rates. Ben Magara, CEO of Lonmin, told Miningmx in September the initiative had worked. Since then, the firm has sought a number of other ‘levers’ in an attempt to survive the low basket price of PGMs.

It bought Anglo American Platinum’s 45.6% stake in the Pandora Joint Venture in November which enables it to realise capital expenditure synergies of $2.6bn which Magara said would lift the net present value of the company – a key measure by which lenders measure its solvency.

On October 6, shares in the company gained 18% as it emerged Lonmin’s lenders would waive the next two debt covenant tests for September just passed and March 2018 provided it left untouched some $200m in undrawn debt. This takes pressure off Lonmin which analysts feared may have to seek public and private funds again following three capital calls on shareholders since 2009 totaling $1.1bn.