[miningmx.com] – THE appointment of Srinivasan Venkatakrishnan (Venkat) to the helm of AngloGold Ashanti completes a seven-month reorganisation of management across four of South Africa’s most prominent precious metal companies. Here’s what we should think of the companies involved and the people appointed to run them.

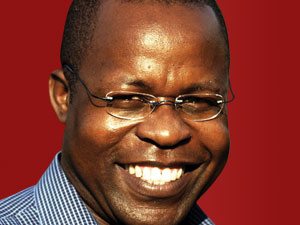

Srinivasan Venkatakrishnan, 46. AngloGold CEO.

Appointed: May 8, 2013.

Venkat, as he is mercifully known, has a background in accounting and was CFO of Ashanti Goldfields, the jewell in the crown of Ghana’s mining industry before it was merged with AngloGold in 2004. Venkat served as CFO until May this year. His appointment was lauded as a solid move as it would continue the legacy established by Mark Cutifani who now runs Anglo American.

“It will be a seamless takeover,’ said David Davis, an analyst for Standard Bank Securities Group. “He has been intimately involved in the group’s strategy with Cutifani,’ he said. That pretty much reflected the accepted view of Venkat’s appointment although not all agreed.

Peter Major, an analyst for Cadiz Corporate Solutions, thought Venkat lacked the leadership credentials.

“Is that the best they (AngloGold’s board) can do? Venkat was there when that installed the hedge book,’ said Major of the financial mechanism in which AngloGold Ashanti sold gold forward at prices well below the market price. It cost Cutifani millions of dollars to “unwind’ the hedge book, although he was able to do it earlier enough to benefit from the bull market in gold.

Venkat strove to impose his own will on AngloGold’s affairs at the firm’s recent March quarter results presentation, saying he would not hesitate to cut unprofitable mines. The company is adding 500,000 ounces of new low cost gold production by 2014, but Venkat said his eye was fixed on profitability, therefore he would be prepared to cut an equal amount of unprofitable gold. Sweeping stuff.

It means the spectre of massive restructuring at AngloGold’s South African mines – a prospect that has already been prefigured with Namibian mine, Navachab which is due to be sold by the year-end.

Another mine is also up for sale soon. Venkat won’t say which, but it’s odds on favourite it will be an South African operation as suggested by Venkat’s recent cautionary words: “We’re not selling soap here. There are stakeholders to be considered’.

Bennetor (“Ben’) Magara, 44. Lonmin CEO

Appointed: April 2, 2013. [Effective, July 1, 2013]

Magara’s appointment at the head of Lonmin was something of a surprise. After serving a stint as CEO of Anglo American’s coal operations in South Africa, Magara took up a technical and project position in Anglo American Platinum (Amplats).

On closer inspection, however, it seems Magara was closely involved with with unions in the wake of the labour disruptions over the past 12 months in the platinum industry.

“Personally I think he is a solid mining person. But he also knows the unions and will provide a good transition because he is a person of colour,’ an asset manager commented. “A well rounded individual. I’m quite positive on the appointment,’ said Sholto Dolamo, an analyst for Stanlib Asset Management.

Magara, Zimbabwean born, ticks one of Government’s boxes which has complained of mining company reticence to appoint a black CEO to their ranks – Anglo American among the many to be criticised by mines minister, Susan Shabangu.

Magara has a good foundation at Lonmin owing to the work of Simon Scott, interim CEO who returns (gladly some say) to his position as CFO. Scott has withstood intense criticism at Lonmin for refusing to bow to former Xstrata Mick Davis’ attempts at a merger (twice). Instead, Scott saw through the $732m recapitalisation of Lonmin’s balance sheet and produced decent interim figures last week.

Magara will have to build on solid operational improvements in a market that most analysts believe will stay depressed for the remainder of 2013 and well into 2014. There’s also the prospect of further corporate action among Magara’s shareholder base; specifically Glencore Xstrata which takes up Xstrata’s 24% stake in the firm.

There’s absolutely no reason Ivan Glasenberg, Glencore Xstrata CEO, would want to hang on to the stake in Lonmin.

Firstly, you can’t trade platinum in the way Glasenburg can in coal, chrome and copper; secondly, it was never his investment therefore he can have little sentiment for a stake Xstrata wrote down last year. This could see Magara looking anxiously over his shoulder at either a significant overhang or in fear of corporate action that could see Lonmin’s ultimate ownership change hands.

Neal Froneman, 52, Sibanye Gold CEO

Appointed: November 29, 2012.

Froneman, quickly approaching veteran status of South Africa’s gold mining industry, has enough experience to know Sibanye Gold, created from the unbundling of Gold Fields’ South African assets, would face headwinds. But he didn’t think it would come from the market.

Two months after listing on the JSE, at a somewhat disappointing R13/share, the gold market tanked. The metal shed $200 per ounce in a couple of days and made Froneman’s job of stabilising the former treasures of Witwatersrand gold basin – Kloof and Driefontein – that much more difficult.

Operationally, Froneman has done okay; more than okay. Following near-disastrous strikes at the end of 2012, Sibanye’s two key mines put in a solid quarter, doubled operating profit in the March quarter which resulted in free cash flow of R590m. The effect is that Froneman is able to cut huge holes out of Sibanye’s R3bn plus debt pile, gathered during the strikes.

This raises the prospect of a healthy dividend – 25% to 35% of normalised earnings is planned – and show the cash generative power of Sibanye Gold’s asset base. The problem for Froneman is that there’s grounds for a perfect storm.

Lower revenue from a poorer gold price will already eat into margins, but another explosion of labour relations discontent at even one of the mines could flatten earnings since Kloof and Driefontein comprise nearly 90% of total profits.

Froneman has already, perhaps unwisely, stirred the pot saying his labour don’t have the appetite for more strike action. In an era of quickly changing labour dynamics, he could rue these comments.

Chris Griffith, 47, Anglo American Platinum CEO

Appointed: September 1, 2013

Seven months is a lifetime as a leader of an South African mining company. It must feel like it for Griffith whose single, largest headache has been finding a way of reducing Amplats’ cost base.

After more than a year cogitating over restructuring possibilities, Amplats set down proposals for cutting 400,000 ounces of productive capacity, a move that would have affected 14,000 jobs at its Rustenburg shafts.

Despite having claimed to have consulted Government and unions, Amplats was battered by mines minister, Susan Shabangu, for arrogance and was immediately faced with losing its right to mine.

Griffith said at the time there was little hope of saving jobs but some three months later, after a prolonged period of consultation with Government and, initially unions, proposals were adjusted to see a 50,000 ounce cut in output saving 8,000 jobs – a much less favourable equation that first planned. If the math doesn’t add up, that’s because Amplats has clearly buckled under Government pressure and is bearing the cost of saving jobs.

Worse, allowing Government to pressure a company to change its business plans creates an uncomfortable precedent for other platinum companies working in a market that has platinum stocks that will keep a lid on prices until market demand truly revives. Impala Platinum, which has already warned of unsustainable operations at Rustenburg, won’t thank Amplats for its retreat.

Griffith now faces steering the revised restructuring proposals through union negotiations including the National Union of Mineworkers and the newly emergent Associated Mineworkers & Construction Union (Amcu) which will not only be opposing Amplats in the months of wage negotiations, but will also be doing so as they jostle each other for members. It makes for a heated labour relations climate and a difficult job for Griffith.