[miningmx.com] – AFRICAN Rainbow Minerals (ARM) is to cut capital expenditure R500m in the current (2016) financial year with roughly half related to the deferment of a shaft deepening project at its Modikwa platinum mine.

Announcing a 58% decline in earnings R1.74bn for its 2015 financial year ended June 30, the group said it would spend R2.4bn in capital expenditure, a R500m reduction and some R1bn lower than capital spend in the year under review. This was in response “… to the lower commodity price environment,” it said.

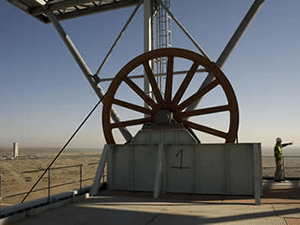

Some R207m in capital would be saved by deferring the deepening of the North shaft at the Modikwa platinum mine whilst there would also be a restructuring at its South 1 and South 2 operations in order to save costs.

“The current market conditions necessitated that the capital projects at Modikwa Mine be reviewed, with the view to reduce capital expenditure without adversely affecting the mine’s future ability to ramp up production,” ARM said.

Modikwa had a bad year owing to section 54 safety stoppages, an extended break during December and a lack of mining flexibility resulting in labour inefficiencies, the company said. The outcome was a R128m reverse in headline earnings resulting in a R64m loss for the year.

“Modikwa is one of those mines is under our control and there is no excuse why we can’t get the requisite response,” said ARM executive chairman, Patrice Motsepe.

As a whole the platinum division reported a 54% decline in headline earnings but it was not alone with nearly all of the group’s sections reporting a decline in contribution. Only ARMCoal and ARMCopper were loss-making, however.

Although ARM has joined the legions of mining companies in cutting spending, its financial position is better than many. Cash generated from operations increased some R435m to R2.5bn while cash on hand fell just over R200m to R1.4bn. Net debt increased slightly to R1.6bn compared to R1.4bn as of June 30 in 2014.

As a result of its relative robustness, ARM continued the dividend – its ninth successive – of some 350 cents/share, down from 600 cents/share which was declared at the end of the previous financial year.

“I am confident about the future,” said Motsepe. “Even if things become much worse, we will continue to perform well,” he said.

From a basic earnings perspective, there was a 97% decline to R104m owing to several impairments including a R784m write-down of the firm’s Lubambe copper project, and a R534m impairment of the firm’s 14% stake in Harmony Gold.

Motsepe repeated earlier comments that the firm remained invested in gold for the long-term and rejected market observations that the group had failed to be proactive with its investment.

“The most irresponsible thing is that in the current environment even contemplating doing something with our gold business that isn’t in the long-term interest,” said Motsepe.