[miningmx.com] – AQUARIUS Platinum gave notice it had ended a two-year period of introspection saying it was considering building brownfields expansions that, if they were all implemented, would lift platinum group metals (PGM) 47% at a capital outlay of $133m.

Since taking the reins at Aquarius Platinum amid a climb-down in metal prices, CEO Jean Nel has run a tight ship shuttering loss-making operations and painstakingly raising the margin at those that remained open.

However, Nel was quick to add that the projects, which also included the restart of the group’s totemic Everest mine, would have to meet investment criteria of lowering average unit costs.

In essence, this means new brownfields platinum at a cost below Kroondal, the company’s flagship operation. It comprised two-thirds of Aquarius’ 331,642 attributable platinum group metal (PGM) ounces at a cost of about R10,000 per PGM oz in the 2014 financial year.

Nel also said Aquarius Platinum was involved in periodic discussions with its joint venture partner, Anglo American Platinum (Amplats), regarding investment in shafts Amplats said it wanted to sell.

“From an Aquarius perspective, there are certain options and permutations we would find interesting,” said Nel of discussions with Amplats. “We continue to evaluate that internally and have conversations with them from time to time,” he added.

Sibanye Gold and Royal Bafokeng Platinum have already stated an interest in buying assets owned by Amplats it deems non-core following an 18-month asset review that recently moved from restructuring to portfolio adjustment.

Amplats said it wanted to sell four shafts in Rustenburg, its Union section, as well as its stake in the Pandora Joint Venture with Lonmin. It also said it was considering quitting its stake in Bokoni Platinum Mine which it shares with Atlatsa Resources.

“Right now they [Amplats] are running their own process. There is nothing I should be saying in terms of specific comments,” Nel said. “They will retain an interest at Kroondal and we continue to work well with them as partners of 10 years,” he said.

Nel was commenting in response to questions at the firm’s full-year results presentation in which Aquarius posted a net loss of $13m – a vast improvement on the $288m loss of the previous financial year but a performance he said “irritated” him as the figures remained in the red.

Aquarius has identified three projects of which the largest is the $70m expansion of its Mimosa platinum mine in Zimbabwe, adding 70,000 PGM ounces. This was excluding the reconfigured $40m replacement project at Mimosa. A scoping and feasibility study on the Mimosa expansion was due by February.

The second project was the Kroondal Tailings Retreatment project which would add up to 20,000 PGM oz at a capital cost of $23m.

In both cases, the projects would be funded from internal cash flow and through the sale of non-core assets including the $37m sale of its Blue Ridge prospect, currently underway.

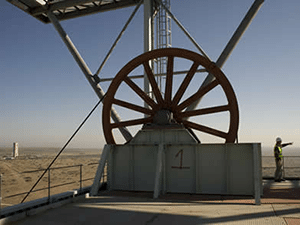

A third project would be restarting Everest, a mine mothballed amid the slide in platinum prices during 2012. Nel acknowledged the mine did not produce at a lower unit cost than Kroondal, but said it would add 460,000 PGM ounces in life of mine production whilst making use of installed capacity.

He warned, however, that the re-opening of Everest would require higher sustainable metal prices. “I would guess we need a 10% to 15% improvement on where we are today,” he said. Kroondal achieved a price received of just over R12,000 per PGM oz in the final two quarter of its financial year.

“The board then has to form a view on whether price is sustainable. It’s a case of once bitten twice shy,” he said.