[miningmx.com] – THE benefits of a stable labour relations environment was clear for all to see at Royal Bafokeng Platinum’s (RBPlat’s) recent interim results in which it posted a 33% improvement in share earnings.

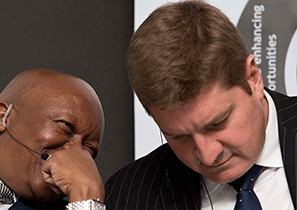

“The results reflect the benefits of having a stable workforce,’ said Martin Prinsloo, CFO of RBPlat which has Anglo American Platinum (Amplats) and Royal Bafokeng Resources as its main shareholders.

Seten Naidoo, an analyst for Standard Bank Group Securities said in a note that RBPlat’s stable operating performance was “… most notably to its enviable labour relations’.

So strong are its relations that the company had sufficient labour personnel during the normally disruptive public holidays in April, he said.

Having one operating asset, and a mountain of capital-intensive project work to trawl through, clearly helps focus the mind.

Taking risks on its labour relations is betting the farm; in other words, without stable cash flow from BRPM, RBPlat will be unable to finance its future.

RBPlat is due to commission its R11.3bn Styldrift project in a year’s time, of which only R3.14bn has been financed, while an extension of BRPM which replaces exhausted reserves rather than expands the mine, is due to sap another R700m over the next three years.

Prinsloo is relaxed about the pressure on the balance sheet; so much so that the board elected to close off a R1bn revolving credit facility which saves it some R600,000 per month in commitment fees.

“Also included in the R11bn on Styldrift is some R2.5bn in escalation and contingency. We haven’t used any contingencies to date so we don’t anticipate the capex will be that much,’ he said.

The company will look for up to R3bn in term debt in the first half of next year at the earliest, he said. It raised R1.5bn in a rights issue earlier this year in the teeth of the platinum strike.

There is no single reason for stable labour relations but a R2.8bn housing and amenities project at the firm’s Bafokeng Rasimone Platinum Mine Joint Venture (BRPM), announced in June, is certainly a contributing factor.

A month later, RBPlat had a wage deal which guaranteed a 9.1% cost-to-company increase over three years – lower than that achieved by RBPlat’s peers Amplats, Lonmin and Impala Platinum – but which also links wages to productivity. A further two years can be added to the wage agreement, but it commits RBPlat to reassessing whether the pay is fair in line with inflation and other factors.

All this without having to resort to strike action. It was of course helpful that the National Union of Mineworkers (NUM) is RBPlat’s main union rather than the more radical Association of Mineworkers & Construction Union (AMCU).