[miningmx.com] – THE Association of Mineworkers & Construction Union (AMCU) is poised to win organisational rights at Northam Platinum’s Zondereinde mine, the firm said in its interim results announcement today.

“Whilst the National Union of Mineworkers (NUM) is the dominant union at Zondereinde representing some 70% of the workforce, the AMCU has gained sufficient membership

which entitles it to organisational rights at Zondereinde,” it said.

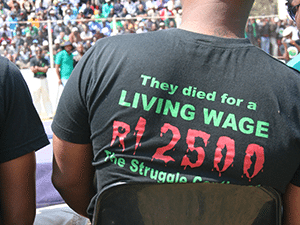

This is a potentially important development given recent unrest at Zondereinde. A 75-day strike was ended in January 2014 which resulted in the current two-year wage deal, but it has not stopped industrial action. Only last month, the NUM called off a one-week strike at the mine.

In notes to Northam’s interim figures – in which the firm swung back into profit – CEO Paul Dunne said the recent strike at Zondereinde was “… indicative of the complex labour and operating climate”.

He added that the financial strength of the group turned on “… stable labour relations and achieving production targets” as well as receiving metal prices above the cost of production.

Notwithstanding future risks, Northam turned in a strong performance for the six months ended December 31 producing headline share earnings of 89.4 cents against a loss of 25c in the interim period of the previous financial year.

This was despite a shaft incident at Zondereinde during the period in which the mine’s No. 1 shaft was out of commission for six weeks. “Zondereinde management did well to

mitigate the losses from this interruption and the business unit put in a commendable performance for the half-year,” said Dunne.

The company’s other asset, the Booysendal project, continued to ramp up with steady state production on track for October 2015.

Booysendal, which is due to produce 160,000 ounces, was part and parcel of Northam’s growth strategy, said Dunne who added Booysendal, if developed in a capital efficient manner, could position Northam at the lower end of the cost curve.

Northam announced on February 10 that it had bought the mothballed Everest mine from Aquarius Platinum for R450m in a deal which will significantly increase Northam’s exposure to mechanised, shallow mining operations.

Once it has ramped up to expected full output of around 250,000 oz/year of platinum group metals, within about four years, the Everest operation would add 50% to Northam’s current annual production said Dunne.

Dunne said the group also remained alive to “… opportunities which may arise from restructuring in the sector and which fits its objective of growing down the industry cost curve” without making mention of specific assets, such as the Union section of Anglo American Platinum (Amplats) which is up for sale.