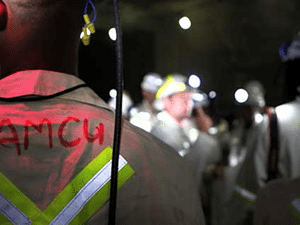

[miningmx.com] – AFTER having sounded a note of optimism that the so-called “government-sponsored’ wage proposal might be acceptable, president of the Association of Mineworkers & Construction Union (AMCU), Joseph Mathunjwa, has performed a 180 degree pivot.

It can only suggest that when Mathunjwa speaks, he doesn’t speak for all of AMCU. Throughout the course of the strike in the platinum sector, now in its 20th week, there have been murmurings of disaffection in AMCU, an organisation that, to all intents and purposes, has not much institutionalised since the Markana atrocity in 2012. The intimidation of those mineworkers considering breaking the platinum strike certainly gives some substance to this perception.

The question now is whether the South African government has any other bright ideas. Mines minister Ngoako Ramatlhodi swept into office hoping to broker a deal even though he was doing so by “spending other peoples’ money’, as one Miningmx reader observed recently.

It was an attempt at “interest arbitration’, no doubt given wings by first quarter economic data only days earlier which showed the economy had contracted, and that the second quarter would show the strike had inflicted greater economic harm.

Notwithstanding the greater interest of resolving the strike, it has to be doubted whether producers could have afforded Ramatlhodi’s 16% wage proposal, even if AMCU had approved it. At the end of the day, a 16% increase is just as unaffordable as AMCU’s 30% demand for the platinum producers.

Even at 9%, which is where the platinum producers have pitched their offer, it’s hard for the likes of Anglo American Platinum (Amplats) to operate profitably.

Based on its average unit costs in its 2013 financial year, a 9% wage increase takes total unit costs to about R22,000 per platinum ounce which is R2,000 per ounce in excess of last year’s average revenue, and more than the current spot price.

In any event, platinum producers will meet with the government today, presumably with some thoughts on Ramalthodi’s offer in the hope that a new deal can be brokered. Outside of that faint hope, the producers will be considering their limited options.

As mentioned previously in Miningmx, they could seek court approval that AMCU has operated beyond its mandate to secure a better living wage for workers. Life for most striking miners is indubitably worse today than when the strike started on January 23. However, a legal challenge of this ilk will take time and will most likely be appealed, and could even find its way to the Constitutional Court.

There’s also the option of mothballing operations. Mine closures, however, are an unlikely option. Shutting a mine would require a process of union and government engagement as troubled, labyrinthal, and time-consuming as the talks that precipiated them.

The third option is that the strike breaks under its own lack of sustainability. Producers now have court sanction to continue communicating with workers.

Amplats reported a return of some numbers as had Lonmin before violence and intimidation broke out in Rustenburg. Impala Platinum would have to reopen its operations for the trickle-back effect to take place.

Throughout this unprecedented strike, heaven knows what international investors think of it. Actually one does know.

They question the “richness’ of the mine minister spending other peoples’ money for his own political gain. Being seen as the person who bridged the unbridgeable span between worker expectations and employer finances is one mighty way to introduce yourself to a leading portfolio like mining, but at what cost to the industry long-term?

Investors also know, only too well, the point made by Citi Research analyst, Johann Steyn, in a report on June 4 in which he pointed out that the providers of capital were at the end of the queue between 2009 and 2013 when the platinum sector distributed its R450bn in revenue earned for the period.

Of total revenue, 33% or R150bn was spent on employee wages followed by suppliers with R125bn or 28% of the total. Shareholders received 5% of the total pie, equal to R24bn and a percent less than government which took home R27bn of the total revenue.

Put another way, employee wages have increased 11% a year between 2009 and 2013 while payouts to capital providers have declined 36% over the same period. In capitalism, which is the system used in the running of mines at present in South Africa, the shareholders are the people who provide the capital that makes it all happen.

Everyone would agree that workers ought be paid more but not at the expense of the farm.

Said Michael Kavanagh, an analyst for Noah Capital Markets in a recent note: “The offers on the table from the companies are more than generous in the current circumstances and leave shareholders with little or no prospect of a return on capital in excess of the cost of capital for the foreseeable future’.