[miningmx.com] – Anglo American Platinum (Amplats) is continuing its campaign to restructure and get rid of non-core assets in the face of grim platinum market conditions today announcing a decision to put the Twickenham mine on care and maintenance.

The group also said it intended selling its 50% stake in the Kroondal mine which is a 50/50 joint venture with Aquarius Platinum which was recently acquired by Sibanye Gold. That makes Sibanye the obvious buyer for the AngloPlat stake but it looks like Griffith intends driving a hard bargain.

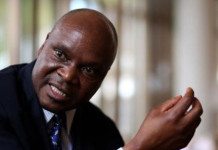

The ground mined by Kroondal includes sections of Amplats’ contiguous Rustenburg division which were placed into Kroondal through “pool and share’ agreements. Sibanye has already struck a deal to buy Rustenburg but Amplats’ CEO Chris Griffith today stressed that Kroondal was “not part of the Rustenburg assets’.

Griffith pointed to the obvious synergies of combining Kroondal with Rustenburg and commented, “this is not a fire sale. We are looking to dispose of our 50% stake in Kroondal for value.’

Amplats had previously announced its intention to sell out of other non-core assets including the Union Mine as well as Pandora – a JV with Lonmin – and the Bokoni mine which is a JV with Canadian junior Atlatsa.

Griffith declined to give specifics on the state of play regarding the disposals of Pandora and Bokoni commenting “these are part of a process and discussions with our partners are on-going’.

He also raised the possibility that Union could be placed on care and maintenance “if Union does not generate cash and a sale cannot be progressed in the first half of 2016.’

Production at Union has already been chopped back to 140,000oz of platinum annually from 220,000oz to restore profitability at the mine which still employs some 6,000 workers.

Queried on precisely what was going to happen to Union if it could not be sold by mid-year Griffith replied, “our first prize is to exit the mine but it is unlikely we will shut down profitable production.’

He added that Union was cash positive following the restructuring and he expected the mine to remain cash positive this year pointing out it was easier to sell a mine that was still making money.

Asked if that meant Union would remain in operation after mid-year if it was still profitable but Amplats had not found a buyer Griffith replied, “you are focussed on the mine staying in operation but we are focussed on selling it.’

Griffith stressed Amplats’ mines generated R4bn in free cash during 2015 and the group reduced net debt to R12.8bn from R14.6bn a year previously thanks to the restructuring programme but the group’s results were hammered through being forced to take impairments totalling R14 billion (post tax) .

Impairments which hit basic earnings included R4.5bn for Rustenburg, R2.5bn at Twickenham, R1.4bn for equity interests in Atlatsa and Bokoni and R3.5 bn for equity interests in Royal Bafokeng Platinum and Bafokeng Rasimone Platinum Mines.

In addition, Amplats wrote off senior loans and working capital facilities loaned to Atlatsa which resulted in an impairment of R1.8bn which affected headline earnings.