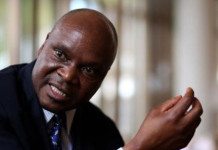

[miningmx.com] – RANDGOLD Resources CEO, Mark Bristow, said it had proved impossible to convert Obuasi in Ghana from a world class resource into a world class mine which is why his company walked from a joint venture in the asset.

Asked at the gold firm’s fourth quarter and 2015 financial year-end results about why he had pulled out of a proposal to share the re-development of Obuasi with AngloGold Ashanti, Bristow said the mine “didn’t meet our investment filters”.

“When we spoke to Venkat [Srinivasan Venkatakrishnan, CEO of AngloGold] we were very clear that while this was a world class resource, could we make it into a world class mine,” said Bristow in response to a question from an analyst.

“It didn’t pass our investment filters. We sat down with Venkat and saw if they could convince us to do a little more work, but they couldn’t do that,” said Bristow. “We gave it our best shot. We walked.”

Randgold Resources values its investment prospects a 20% return and a gold price of $1,000/oz. However, it was clear that Bristow was also seeking some profound concessions from the Ghanaian government regarding an asset it had first mined in 1897 when it was Ashanti Mine.

AngloGold Ashanti spent $100m financing the development of Obuasi’s decline shafts. It was estimated it would spend about $50m in 2016 keeping the company in mothballs, or until another partner could be identified. Before it was put on care and maintenance, the mine cost AngloGold $300m in cash burn a year.

Bristow said Randgold had ‘recut’ its mining plans for five years from 2016 with gold production expected to move from 1.2 million oz in 2015 – a company record – just below 1.4 million oz from 2018 to 2020.

During this period cash costs would fall to just under $600 per ounce from $700/oz while capital expenditure would decline heavily to under $100m in 2020 from about $370m in the year under review.

The effect was to review all mine plans with “a focus on true returns and break-even cash flows”. As a result, Loulo-Gounkoto and Kibali would produce 600,000 oz each at $600 per ounce for 10 and 12 years respectively.

The company’s Tongon mine was forecasting to produce an average of more than 300, 000 ounces for five years. Randgold operates Kibali with AngloGold Ashanti in a joint venture therefore attributable production is 300,000 oz.

“Our mines can continue to generate cash flows at gold prices well below the $1,000/oz level. Our positive production and cost profile extends beyond 10 years,” said Bristow.

Randgold earlier today unveiled record gold production of 1.2 million oz for its 2015 financial year but the lower gold price resulted in a $59m decline in profit to $212.8m. Nonetheless, the company has recommended a 10% increase in the dividend.

“It’s easy to achieve when the stars are all aligned but it’s a lot more difficult in a market as challenged as this one, which makes these results even more pleasing,” said Bristow.

He expected the gold price to trade at between $1,000 to 1,400/oz although in the short term a trading band of $1,000 to $1,200/oz was “more realistic”.

Said Bristow of the recent improvement in the dollar price of gold: “Everyone woke up after Christmas and saw the world wasn’t as healthy as thought it was. What did they do? They shifted to gold.

“In the medium- to long-term, I am very bullish on gold because the industry has consumed itself by buying itself without doing any exploration and so it has destroyed value. That’s got to be marked to market eventually,” he said.