[miningmx.com] – It never rains but it pours – on top of the dispute with the Department of Mineral Resources (DMR) over mining rights at the Sishen mine as well as coping with plunging iron ore prices Kumba Iron Ore is now involved in a fight with the South African Revenue Service (SARS) over a claim for R1.8bn in back taxes.

That’s the result of a tax audit by SARS for the period 2006 to 2010 which, according to Kumba, indicates ” potential adjustments to the Group’s taxable income for the period of R6.5bn which would, if the company is finally assessed on this basis, result in additional tax of approximately R1.8bn excluding any potential interest and penalties.’

Kumba has responded by “strongly objecting to the basis for the proposed adjustments’ and says it is waiting for SARS’ reply.

But that’s not the end of it because Kumba has also reported – in its results for the year to end-December published this morning – that SARS is now carrying out a field audit covering the 2011 to 2013 years of assessment.

Kumba states that, “the group believes that these matters have been appropriately treated in the results for the year ended 31 December 2015.’

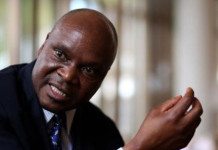

Kumba CEO Norman Mbazima has also provided some more detail in the latest results on the dispute with the DMR over the residual 21.4% share of the mining right at Sishen mine which the Constitutional Court ruled in December 2013 could only be applied for by the Sishen Iron Ore Company (SIOC).

SIOC applied for the right in 2014 which was granted by the DMR but subject to the imposition of certain “conditions’ attached to the mining right which the DMR described as “proposals’.

Mbazima reported today that , “the most significant of these proposals include the reversion to the lapsed 2001 cost-based supply agreement with Arcelor Mittal SA as well as the establishment of a supplier park to provide the mining industry with a significant portion of its capital goods in support of local procurement.’

He commented, “SIOC believes that the MPRDA (Minerals and Petroleum Resources Development Act) does not provide for the imposition of such conditions as contained in the consent letter and, further, that certain of the conditions described as “proposals’ are not practically implementable and lack sufficient detail to provide the company with legal certainty as to the requirements for compliance.

“SIOC therefore believes that the proposals are incapable of being unilaterally complied with. Until the legal and practical implications of the proposed conditions have been clarified with the DMR , SIOC is unable to accept the conditions.’

Kumba’s total revenue for 2015 of R36.1bn was 24% down from the 2014 level of R47.6 bn mainly because of the drop in FOB (free on board) iron prices to $53/t last year from $91/t in 2014.

Group profit for the year plunged to R627m in 2015 from R14.1bn in 2014 and no dividend was declared.