LONMIN suffered a body blow today with the departure of its chief operating officer Ben Moolman who has resigned owing to “personal reasons”.

“The board of Lonmin announces that Ben Moolman has resigned as chief operating officer and as a director for personal reasons. He will leave with effect from 5th April 2017,” said the platinum producer.

“My colleagues and I would like to thank Ben for his contribution to Lonmin and wish him well in his future career,” said Ben Magara, CEO of Lonmin in a statement.

Shares in the company were off 1.6% in early Johannesburg trade taking losses for the month to some 22%. Lonmin is currently valued at just under R5bn.

Lonmin is under heavy pressure currently owing to an uninspiring platinum group metal basket price and, more immediately, the strength of the rand against the dollar.

Analysts believe the company will continue to be cash flow negative despite a restructuring programme last year in which it cut 6,000 jobs – about 15% of its total staff complement.

Said Christopher Nicholson, an analyst for RMB Morgan Stanley, in February: “Lonmin remains in a difficult position – struggling with operational under-performance and deeply cash flow negative after capex.

“Management highlighted various remedial actions; however, each comes with a potential negative consequence in our view,” he added, listing risks related to under-investment and a lack of orebody development.

René Hochreiter, an analyst for Noah Capital, said the resignation of Moolman might be related to the low production rates at Lonmin over the last few months. “We are concerned that results may be poor even in the usually good second quarter,” he said in a note.

Lonmin’s operational and financial difficulties deepened in the first quarter of its 2017 financial year in which it said it was losing money and might cut capital expenditure as the year progressed.

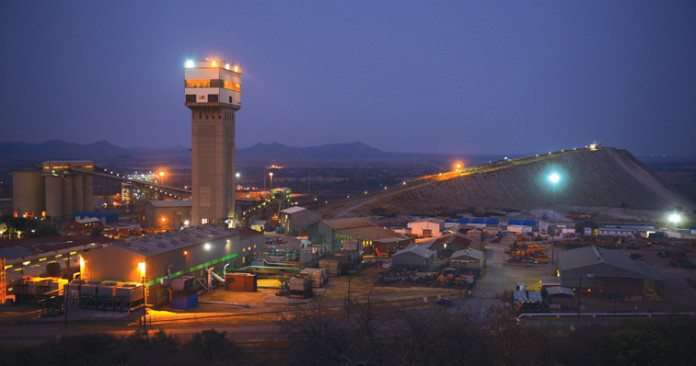

The first quarter, which is usually the worst for Lonmin owing to seasonal holidays, was typified by lower-than-expected productivity and absenteeism at its Rustenburg premises.

Metals in concentrate platinum production at 152,925 ounces in the quarter was 8.4% down compared to the first quarter of 2016. PGM metals in concentrate output was 8.6% lower. Refined PGM output was a fifth lower coming out at 263,283 oz.

However, the group said it would stick to its production guidance of between 650,000 and 680,000 ounces of platinum, but effectively acknowledged it was at the mercy of the platinum group metal (PGM) market.