THE suspension of former mines minister, Mosebenzi Zwane’s Mining Charter, first published in June 2017, was described as the highlight moment in the last 12 months for the South African mining sector by PwC, an auditor.

Commenting in ‘Mine: 2018’, its data-heavy analysis of Johannesburg-listed mining stocks, the auditor said today the JSE’s resources index recovered the gap between it and the HSBC global mining index when the Mining Charter was abandoned. Mines minister, Gwede Mantashe has since gazetted an updated version of the Charter which is far improved, but has questions and uncertainties attached nonetheless.

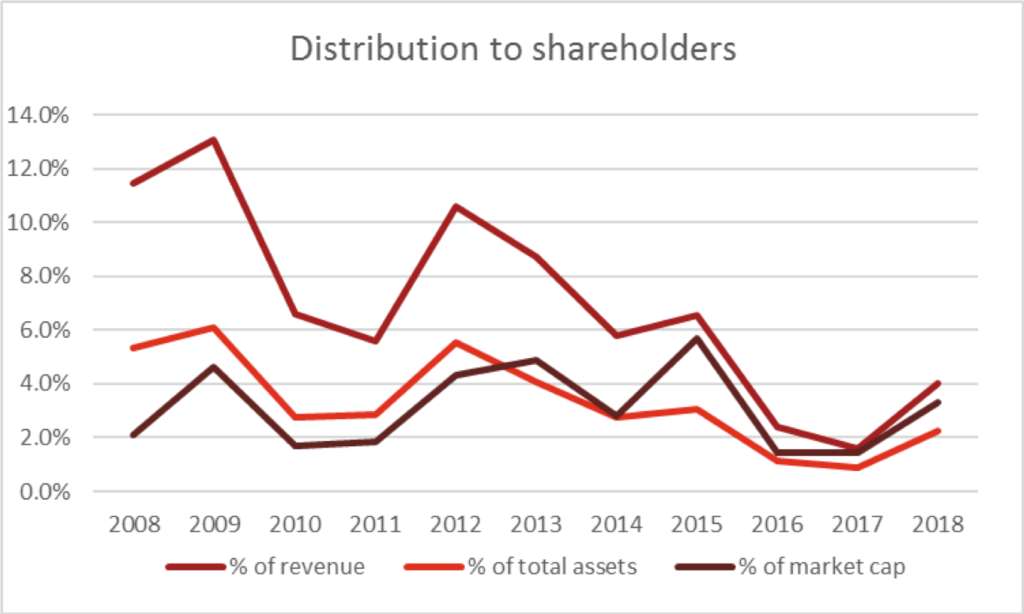

The JSE’s resources index also out-performed the JSE All Share Index last year, the first time it has outstripped the general market since 2008. Dividends increased to R16bn, an increase of R10bn year-on-year, but impairments were also higher and margins were eroded, a largely a function of the country’s exposure to precious metals.

The top revenue numbers were provided by bulk mining companies in iron ore, manganese in particular, and coal, whereas the gold and platinum stocks struggled. In real terms, the dollar platinum price was at 2003 levels, described by PwC partner, Andries Rossouw as “a shocking” revelation delivered by the report.

Handily, a 90% improvement in the rhodium price and 33% increase in palladium, whilst a leap in chrome prices (since largely corrected), contributed towards an improved basket price for the platinum group metals, PwC said. The condition of the basket in the period in review was that 40% consisted of other metals with the balance drawn from platinum revenue. The last time palladium in particular made such a large contribution to the basket price was during a period of heavy thrifting in autocatalysis, back in 2003.

“There are some encouraging signs regarding the cooperation we’ve seen between the mining industry and the Department of Mineral Resources (DMR),” said Rossouw on Mining Charter progress in the last 12 months. “There are still some sticking points that need to be addressed,” he added.

One is how mining companies are expected to recover the cost of the carried interest required they give to communities in order to qualify for new mining rights as set down in the new Mining Charter. “We don’t know. I imagine it might be some kind of loan structure,” said Michal Kotzé, PwC Africa Energy Utilities & Resources Leader in response to media questions at a presentation.

Commenting on prospects for the current year, Rossouw said another potential flashpoint would be the socio-economic conditions around mining properties. “We are going into an election year so it will be interesting to see how that unfolds,” he said.

KEY HIGHLIGHTS OF PWC REPORT (31 JSE mining companies used in report)

- Market capitalisation at 30 June 2018 increased 15% to R482bn.

- SA EBITDA margin of 22% is lower than global rate of 24%.

- Free cash flow fell 45% year-on-year to R17bn from R31bn.

- On aggregated basis, industry report net loss of R11bn from R16bn owing to:

- R46bn impairment reversal compared to R22bn reversal in previous year.

- Impairments over last five years now reached almost 200bn.

- Net borrowings to EBITDA 0.8x compared to 0.6x in previous year.