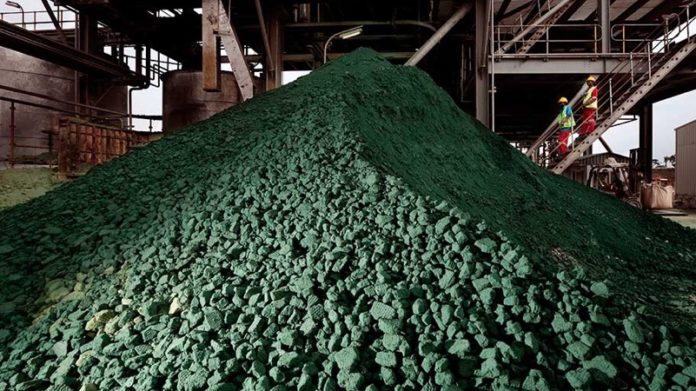

COBALT prices have gained more than 30% since Glencore announced earlier this month it would close the world’s largest mine, said the Financial Times.

Glencore confirmed at its interim results announcement on August 7 that it would mothball its Mutanda mine in the Democratic Republic of Congo (DRC). The decline in the cobalt price and under-performance at the mine were some of the reasons for its decision which Credit Suisse said would lead to a change in the cobalt market.

“The silver lining being that this move (putting Mutanda on care and maintenance) will likely have significant positive consequences for cobalt pricing with Mutanda providing 15% of the global cobalt market,” the bank said in a report.

The rise of electric cars propelled cobalt to its highest level in 10 years of $44 per pound in April last year before crashing to $12/lb following a surge in supply and stockpiling by companies in the battery supply chain, where cobalt is used, said the Financial Times.

A consequence of the decline in cobalt prices for Glencore was that the firm’s marketing division held on to material it might otherwise have sold.

This resulted in a mark-to-market non-cash loss of $350m without which the firm’s marketing division’s adjusted earnings before interest and tax (EBIT) would have been only 13% lower year-on-year versus the actual 35% decline.

Commenting on the decision to mothball Mutanda, as well as embark on a business renewal of its other African base metal assets, RBC Capital Markets commented: “We view this move as a positive for the shares as this will reduce volatile DRC exposure from 2020 and will reduce the capex burden leaving free cash flow (FCF) higher despite the lost production”.