THUNGELA Resources said extending an existing coal freight contract with Transnet was good business even as the state-owned rail and ports firm opened the door to a new supply structure through an independent, third party regulator.

Thungela CEO July Ndlovu said Transnet’s Network Statement in December aimed at establishing a public private partnership with mineral bulk miners “has not got us excited just yet”, although he added his company would continue to monitor its progress.

“We need to understand the cost structures of those third parties, and how it compares with the current service provider where we have already signed a three-year contract which gives us some certainty,” he said.

“We have to be clear on cost competitivness and providing security of capacity. At this stage we have not seen anything that has got us excited – just yet.”

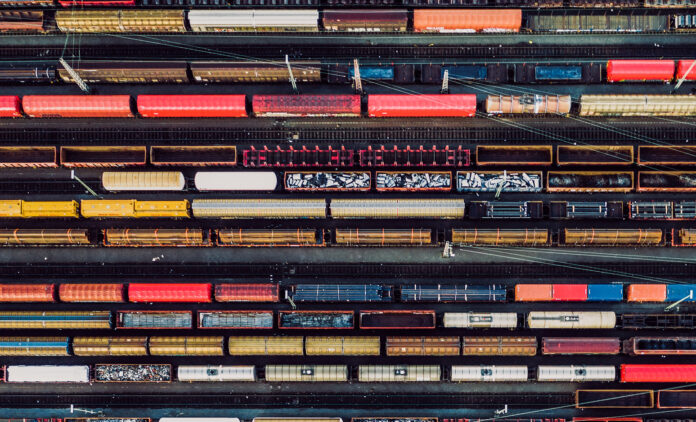

Thungela’s renewed coal contract with Transnet is for three years on the same industry adjusted terms of 63 million tons (Mt) a year in total (down from the 71Mt first agreed with Transnet by the industry until it was lowered to account for rail and locomotive problems).

Poor investment and management of the coal line that connects the coal-rich Limpopo and Mpumalanga provinces with Richards Bay Coal Terminal has resulted in a drastic decline in Transnet’s performance on the iron ore and coal freight lines. Deliveries of coal to RBCT fell to a 30-year low of 49Mt in 2023.

But Transnet’s performance is starting to show signs of recovery. Thungela has guided to export sales production of as much as 13.7Mt this year which assumes a run-rate on the coal line to RBCT of about 58Mt compared to a run-rate of 51.9Mt last year.

The Network Statement is seen as the state-owned ports and rail company’s first tentative step towards public private partnership ahead of full-blown concessioning. But Ndlovu said there was a lot of water to flow before any agreement could be reached.

“There are so many models being floated out there. Don’t listen to any one of them,” said Ndlovu in an interview with Miningmx. “Alot of what we are seeing now is not a policy-designed model, but rather private players punting what they think is most appropriate [for them],” he said of possible long-term concessioning.

“The guys in the iron ore industry have a completely different model [to the coal industry]. When you have rats and mice as in our [coal] corridor, it is likely to be different. The pragmatism of signing for three years [with Transnet] as we’ve done is to allow for the confusion to work itself out so we can understand what it will look like,” he said.

Ndlovu’s comments mirror a similar outlook at Exxaro Resources which pumped a portion of its coal exports to Maputo in Mozambique rather than cut production, even if the freight is lossmaking at currrent export coal prices ex-South Africa.

Exxaro has targeted exports of up to 7.35Mt in 2025, close to its capacity. Its head of marketing Sakkie Swanepoel said it was important to keep the channel open – a view that demonstrates some degree of scepticism of Transnet’s recovery plans.