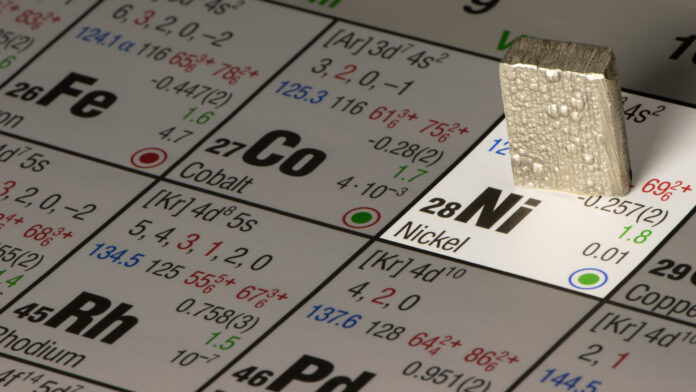

EUROPEAN Union regulators warned MMG’s proposed acquisition of Anglo American’s Brazilian nickel operations could divert ferronickel supplies from Europe, potentially harming its stainless steel industry, said Reuters.

The European Commission said redirecting ferronickel from European markets would threaten manufacturers’ ability to produce high-quality, low-emission stainless steel at competitive prices. The deal, announced by Anglo American in February, includes two ferronickel facilities and two undeveloped projects in Brazil.

Teresa Ribera, the EU’s competition chief, said ferronickel was a key input for European stainless steel production, which serves many industrial sectors. The Commission said Europe’s ability to access this material was critical.

Regulators warned that supply diversions combined with limited alternative sources could raise costs and affect quality across European stainless steel production, weakening manufacturers’ global competitiveness.

Both MMG and Anglo American said they remained committed to completing the transaction. The companies previously offered a supply arrangement whereby Anglo American would purchase ferronickel from MMG for European distribution over ten years to address regulatory concerns, calling this the optimal outcome for customers.

The Commission has until March 20 to decide whether to approve or block the acquisition, though this deadline may be extended if the parties submit additional proposals.

The concerns reflect broader issues around critical mineral supplies and China’s market influence. Stainless steel manufacturers across Europe depend on reliable ferronickel supplies to maintain production standards while meeting environmental requirements, said Reuters.