BHP Group disclosed on Tuesday that it has agreed to reduced pricing for certain iron ore shipments whilst negotiating a 2026 supply contract with Chinese buyers, even as the company achieved record first-half production.

The miner revealed a 20% cost overrun at its Canadian Jansen potash development, with total investment now estimated at $8.4bn against a previous forecast of $7bn to $7.4bn.

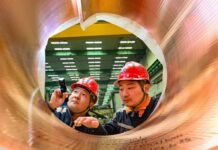

BHP is finalising annual contract terms with state purchaser China Mineral Resources Group whilst exploring alternative markets for its products.

“During negotiations, we continue to optimise product placement distribution channels and take actions within our operations to preserve operational flexibility and productivity,” the company said. “This has seen some impact to realised price.”

Since September, CMRG has instructed steelmakers and traders to halt purchases of multiple BHP iron ore grades, according to sources.

The company reported first-half iron ore output of 146.6 million tons from Western Australian operations on a 100% basis, up one percent year-on-year. Full-year guidance remained at 284Mt to 296Mt.

BHP raised its copper production outlook to 1.9 million to two million tons, lifted from a previous floor of 1.8Mt, citing strong operational performance.

Shares fell two percent amid broader sector weakness.