A DECADE-long dispute over rail access has been resolved, clearing the way for Ivanhoe Atlantic to develop its $1.8bn Kon Kweni iron ore deposit in Guinea and pursue a listing in the US rather than Australia, said the Financial Times.

The company received formal approval from Liberia earlier this month for rail access along what it calls the “Liberty corridor”, ending years of delays to the project. Executive chair J Peter Pham told the Financial Times the company was now considering a listing “most likely in the US, perhaps an Australian secondary listing, but that is to be determined”.

The shift marks a reversal from previous plans to list in Australia, where bankers were hired last year to explore an initial public offering. Pham said the Trump administration’s support for mining has “affected our calculus” in selecting the listing location.

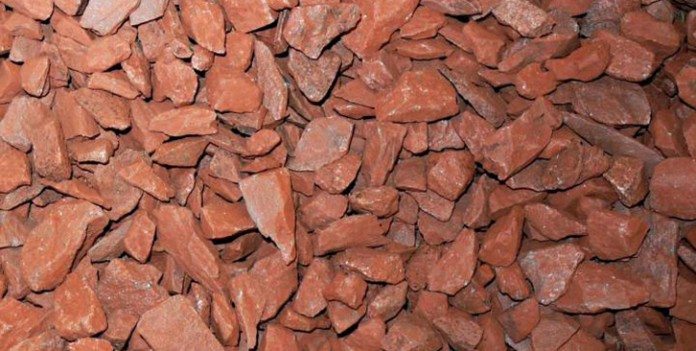

Backed by Canadian-American mining billionaire Robert Friedland, the project will produce iron ore with 66.5% purity – amongst the world’s highest grades. Friedland has described the output, also known as Nimba, as the “beluga caviar” of iron ore.

“We are not in a hurry to go public; we want to do it well,” Pham said, adding that the company has received “very positive feedback” from US government officials at all levels.

The Liberian legislature ratified the rail access bill in December, with the government issuing its final approval this month. Previously, priority use of the line belonged to operator ArcelorMittal. Ivanhoe Atlantic says shipments could begin in the first half of 2027.