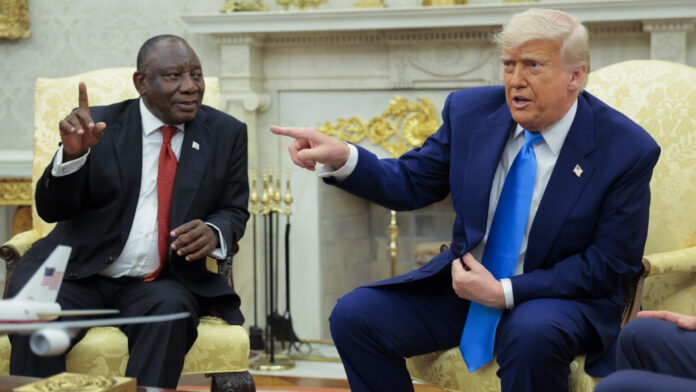

SOUTH Africa is not blessed with large reserves of the world’s minerals du jour, rare earths. So when President Cyril Ramaphosa offered supplies of it to President Donald Trump during that infamous White House meeting in May, geologists must have been scratching their heads.

“That was our project,” says George Bennett, CEO of Rainbow Rare Earths, a UK-listed firm that is planning to extract rare earths from a project in Phalaborwa, Limpopo. According to Bennett, the project was namechecked by The Washington Post. “Someone told the president about the article,” he says.

Unfortunately for Ramaphosa, the US has already beaten him to the project. Its International Development Finance Corp has pledged $50m in equity finance for the Phalaborwa project for a stake in TechMet, an 11.7% shareholder in Rainbow Rare Earths. TechMet is run by Brian Menell whose family helped build the Anglovaal group.

The US identified rare earths as strategic minerals during the administration of former president Joe Biden, after recognising China’s dominance in the sector. About 70% of rare earth concentrates are mined in China, according to the US Geological Survey (USGS). What’s more, Beijing controls 91% of all refined output, of which 90% is in-country. This gives China outsized bargaining power.

When Trump imposed tariffs, Beijing reduced exports of minerals such as neodymium and praseodymium (NdPr). The names don’t exactly trip off the tongue, but these minerals are crucial in making permanent magnets used in wind turbines, humanoid robots and fighter jets. So dominant is China in its production that it controls pricing.

That was until July 10, or so the US hopes. On that day the US department of defence (DOD) signed a supply agreement with US-listed, fully integrated rare earths producer MP Materials, establishing a public-private partnership that aims to create an end-to-end domestic supply chain, thus reducing foreign dependency. Importantly, the agreement includes the 10-year supply of NdPr at a floor price of $110/kg, compared with the current spot price of about $60-$63 per kilo.

Bennett describes this pricing mechanism as “manna from heaven” because it incentivises new Western supply and builds in magnificent margins for his project. As The Washington Post noted, Rainbow Rare Earths’ Phalaborwa project is one of the few potential suppliers of NdPr to the US in the short term. The company is due to publish optimised flow sheets on its process plans, with a feasibility study for the project, which may cost $317m to develop, to follow.

The DOD agreement with MP Materials will also convince NdPr buyers of the need for a price premium. Bennett says there are signs of this happening. When he raised the topic of setting a floor price for Phalaborwa’s product during recent discussions with offtakers, “they weren’t flinching”, he says. “And now that’s been borne out by the DOD deal, just a couple of weeks ago.”

The deal between the US government and MP Materials hasn’t gone down well with everyone.

Market analysts say it smacks of state intervention more typical of Beijing than Washington. In addition to the price agreement, the US has acquired a stake in the company, committing $400m in funds.

But according to Bennett, it could enable US businesses to build up to 6,000t per year of rare earth magnets. In 2024, China produced 300,000 tons of one common type of rare earth magnet, according to The Washington Post.

Berenberg bank analyst Richard Hatch says: “This deal is game-changing for rare earths and will act to reduce the dominance of China over the rare earth supply chain.”

And it might be good for Rainbow Rare Earths too. “Rainbow’s Phalaborwa project is a tier 1 project that can benefit from the DOD’s step-change for the rare earths space,” he says.

A 2024 interim economic assessment by Rainbow said Phalaborwa could produce 1,900t of magnet rare earth oxides per year. The global production of rare earth oxides was 350,000t in 2023, with nearly 70% of that in China, according to the USGS.

What’s more, Phalaborwa stands to be remarkably profitable if it gets the go-ahead. As a brownfields project, Phalaborwa has the ability to produce a high-purity NdPr oxide product with about 70% in earnings before interest, tax, depreciation and amortisation margins, says Hatch.

Bennett says of the Phalaborwa project: “We are starting to engage with debt providers and we are actively starting to negotiate contracts. The DOD agreement sets a very good benchmark across the Western supply chain for rare earth supply. People are going to have to use a similar price benchmark for offtake negotiations. I believe they’ve done us a very big favour.”

A version of this article first appeared in the Financial Mail.