AUTOMAKERS across Europe are confronting potential factory closures by mid-July as Chinese export restrictions on rare-earth magnets threaten to trigger the industry’s third major supply chain crisis in five years.

Frank Eckard, CEO of German magnet maker Magnosphere, told Reuters on June 9 the situation as “full panic” across the automotive sector, with desperate manufacturers willing to pay any price for alternative supplies. Several European auto-supplier plants have already shut down, according to industry association CLEPA.

“Sooner or later, this will confront everyone,” CLEPA Secretary-General Benjamin Krieger told the newswire.

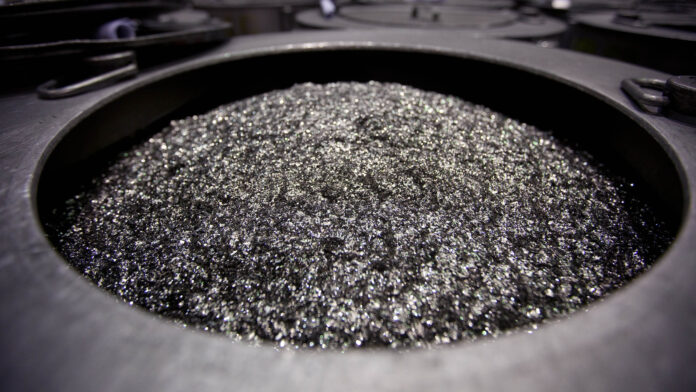

The crisis stems from China’s dominance over rare-earth production, controlling up to 70% of global mining, 85% of refining capacity and about 90% of magnet production, according to consultancy AlixPartners. These materials are essential for dozens of automotive components including side mirrors, speakers, oil pumps and braking sensors.

President Trump announced on June 6 that Chinese President Xi Jinping had agreed to allow rare-earth minerals and magnets to flow to the US, with trade teams scheduled to meet this week.

The shortage threatens to replicate previous supply chain disasters that have plagued the industry since 2020. The coronavirus pandemic forced factory closures, followed by a semiconductor shortage that eliminated millions of vehicles from production plans between 2021 and 2023, said Reuters.

Despite efforts to diversify supply chains following these crises, the rare-earth bottleneck has left automakers with few alternatives. The fate of assembly lines now rests with Chinese bureaucrats reviewing hundreds of export permit applications.

Companies including General Motors and BMW are developing motors with reduced rare-earth content, but most efforts remain years away from commercial scale. Minneapolis-based Niron has raised over $250m for rare-earth-free magnets, planning a $1bn facility for 2029 production.

“This just is a warning shot,” said supply chain specialist Andy Leyland, noting China’s control over 19 key raw materials.