ZIMBABWE’S spodumene concentrate exports jumped 30% in the first half of 2025 despite weak global lithium prices, said Reuters citing official statistics.

Africa’s top lithium producer exported 586,197 tons of the lithium-bearing mineral between January and June, compared to 451,824 tons during the same period last year, according to Minerals Marketing Corporation of Zimbabwe (MMCZ) data obtained on Monday.

Lithium prices have tumbled nearly 90% over the past two years due to oversupply, though producers remain optimistic about long-term prospects amid the global shift towards cleaner energy and electric vehicles.

“A notable market contradiction was observed in the lithium sector, where prices declined despite a continuous rise in demand for lithium metal,” state minerals marketer MMCZ said, adding that prices are expected to improve in the medium-term.

Chinese companies dominate Zimbabwe’s lithium mining, including Zhejiang Huayou Cobalt, Sinomine, Chengxin Lithium Group, Yahua Group and Tsingshan, which produce concentrates and ship them to China, said Reuters. These firms have invested over $1.4bn since 2021 to acquire and develop lithium assets, it added.

Zimbabwe plans to ban lithium concentrate exports from 2027 to promote local processing. Huayou, which exported 400,000 tons in 2024, has begun building a 50,000 ton per year lithium sulphate plant domestically. Sinomine has announced plans for a $500m lithium sulphate plant at its Bikita mine, said Reuters.

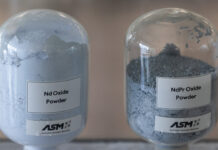

Lithium sulphate is an intermediate product refined into battery-grade materials such as lithium hydroxide or lithium carbonate used in manufacturing.