[miningmx.com] – BINDURA Nickel Corporation (BNC), the base metals miner owned by the UK-listed Mwana Africa, may bolster its efforts to revive its smelter with a contract to process concentrate from Zambia.

Discussions are underway with Zambia’s Munali Nickel which has been reopened after three years by UK mining firm, Consolidated Mining Investments. Munali was previously operated by Jinchuan Group and Albidon before that.

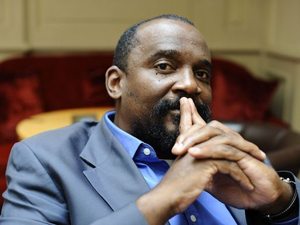

Mwana has a 75.4% stake in BNC which is separately listed on the Zimbabwe Stock Exchange. Kalaa Mpinga, CEO of Mwana Africa, said treating concentrate from the Munali mine was but one of several options for BNC’s smelting facilities.

The ultimate aim is to have the smelter upgraded so that it can treat platinum matte supplied by the platinum producers operating in Zimbabwe such as Impala Platinum or Anglo American Platinum.

These platinum miners are under growing state pressure to produce the finished article in Zimbabwe rather than exporting the matte, which attracts a higher margin than just mining ore, to South Africa.

Mwana Africa had put BNC’s assets under care and maintenance in the past few years owing to suppressed nickel prices. It is now hoping to secure $26m in order to bring the BNC refinery out of mothballs, half of which will be externally funded.

“Our continuous exporting of concentrate is costing the company and this gives us every reason to revive the smelter,’ said Batirai Manhando, MD at BNC.

Giving priority to the base metals smelter, however, means that other projects that Mwana had on the drawing board, such as BNC’s Shangani nickel mine, will be delayed.

“The mine (Shangani) requires more than $50m to bring back in line, but because its grades are low we may continue having it on care and maintenance,” said Manhando.

“To take advantage of economies of scale, the company is instead targeting the Hunters Road project,’ said Manhando.

Company executives have previously said that the Hunters Road project was “the future of the company as it has a huge resource’ while it also has “all the infrastructure and power’ in place.

The project, which has been described as low cost, has “at least 200,000 tonnes deposits of nickel’ and is “open pittable’.

BNC is targeting to ramp up production from its currently producing Trojan nickel mine by 17% from last year’s 7,000 tonnes of the metal.

Mining executives say stronger commodity prices will provide additional scope to expand operations and grow production. Manhando added that his company held an optimistic view on demand trends for base metals.

“We continue to be optimistic because the demand for stainless steel in the world is growing considering that most countries have now started infrastructural projects on a large scale,’ said Manhando.