[miningmx.com] – A RELATIVE air of calm has descended on the well appointed fields, and the cement of Megawatt Park – the corporate headquarters of power utility, Eskom; relative, because even by Eskom’s standards, 2015 was chaotic.

Economy-wrecking load-shedding, internecine board battles, and whispers of imminent bankruptcy were business as normal for Eskom this year. Not since the volcanic days when Jacob Maroga and Bobby Godsell duked it out on Eskom’s board had the company experienced such a leadership vacuum.

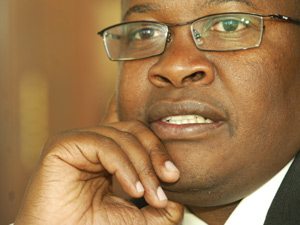

Eventually, public enterprises minister, Lynne Brown, stepped in swiftly followed by Brian Molefe whom she “borrowed’ from Transnet. The talk at the time was that Molefe would serve an initial three-month period which was then extended to six months.

As if he had any choice.

Molefe was appointed Eskom’s full-time CEO in September with the task of restoring public confidence in the company starting with addressing the alarming frequency of load-shedding.

Handily, Spring had arrived which helped cut the pressure on the system, but Molefe is also a strong leader with a thorough understanding of process, controls and accountability. He lifted morale at the organisation and gave a tighter structure to the maintenance programme which he dubbed “a festival’ when a lot of it was required to be done.

His experience as head of the Public Investment Corporation also gives him insight into the private investment sector like few other civil servants. The appointment of Anoj Singh, his former sidekick at Transnet, as Eskom’s CFO is another crucial appointment and will help dispel the fear Eskom’s bank account is about to topple over (helped by the South African government equity of course).

However Molefe can also be combative and divisive.

The mining sector has borne the brunt of this with his insistence that old-style cost plus coal contracts, the fuel his power stations burn to operate, are no longer fit for purpose. The mines are old, the product is falling below specification levels, and paying over the odds for coal is not something Eskom will do – he says.

Already, Molefe has crossed swords with Glencore, refusing to bow to demands for more expensive coal such that Glencore put its Optimum Mine into business rescue proceedings. Another may follow in the form of Exxaro Resources’ Arnot mine after a similar disagreement over adjusting coal contracts.

In his favour, Molefe has political clout and resiliance which enables him to stand up to government pressures better than some of his predecessors. Having guided Transnet from faltering behemoth to a profit-maker buys him time, especially in the eyes of stakeholders.

For 2016, Molefe will have to deal with the backlash of reclaiming R22.8bn in terms of Eskom’s regulatory clearing account which allows it to claw back costs for previous financial years, in this case the 2013/14 period. There will also be concern about the rate of progress on Eskom’s Medupi and Kusile power projects.

Helpfully, the 1,300MW Ingula pumped storage scheme would come on earlier than planned with the first 335MW due in early 2017. This will help create the notion that the supply of electricity is only getting better.