[miningmx.com] – PLATINUM producer, Lonmin, cemented its status as a company on the comeback trail producing more platinum and better full-year earnings than expected earlier this month.

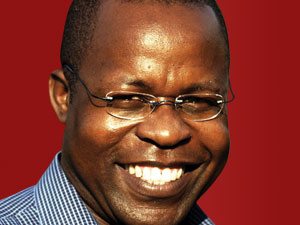

The market loves over-delivery and analysts think that CEO Ben Magara’s guidance for 750,000 ounces in the company’s current (2014) financial might be slightly conservative, although one can’t say for sure. There are risks, of course.

Labour is the Grinch about to spoil Christmas, or the warm glow of its after-effects. As expected, the Association of Mineworkers & Construction Union (AMCU) declined to call a strike over wages this year, but may reprise industrial action after the year-end break.

A strike before Christmas would have been shorter than one afterwards which could mean a three to four week hiatus to production at about 75% of South African platinum production is yet to come.

A strike in the dying days of December was always a high risk route for Joseph Mathunjwa, president of AMCU, as workers would have been reticient to sacrifice the pre-Christmas salary. In addition to being shorter, a pre-Christmas strike would also have been more difficult to orchestrate, especially as it’s thought AMCU wants to simultaneously strike at Impala, Amplats and Lonmin.

The other risk to Lonmin production in the current financial year is Section 54 issuances. This is the government document somewhat draconically waved about at mine premises for safety breaches of different ilks and instances.

Outside of that, and barring production lapses, Lonmin’s future is a much rosier one. “This has been a transition year for the company following last year’s refinancing,’ said Investec Asset Management in a report.

Magara has even raised the prospect of resuming dividend payments.

First, however, he must halt the net cash outflow of 28 cents per share (2012: -41.8c/s) although in its defence there was a $189m negative impact on cash flow owing to significant stock-build in the year as it replenished its pipeline following smelter downtime.

The group has net cash of $201m on its balance sheet and capital expenditure has been guided to $210m. The trick to its immediate future is keeping costs in check. The company reported total costs of R9,182/oz against a basket price of R10,921/oz.

Analysts are sanguine on the stock, however.

“Prices need to improve from there for the stock to perform and with an improving auto market there could be a better chance of this for the next financial year,’ said John Meyer, an analyst for SP Angel, a UK stockbrokerage.

Hanre Rossouw, head of commodities for frontier and emerging markets at Investec Asset Management, said Lonmin had stolen a march on its rivals.

“The positive for me is that they at least six to 12 months ahead of other major PGM producers when it comes to restructuring and streamlining of their overheads with still further savings to be seen on a full-year basis in 2014.

Said Justin Froneman, an analyst for Standard Bank Group Securities: “The company has transformed itself over the last 12 months after the tragic events at Marikana.

“In our view, the current management team is well positioned to maintain the momentum of the operational turnaround and drive returns for all stakeholders. Shareholders have already come to the party, now it’s the turn of organised labour,’ he said.

Longer term, management is seeking to shift up to 80% of its production to three or four large, newer and more efficient shafts, a strategic objective that may put pressure on the dividend given the capital requirements.

The K4 project, placed on care and maintenance last year, is a low cost operation, but in the estimation of one analyst it’s an initiative that requires a platinum price of $1,800/oz to justify the outlay.

That’s well below the $1,455/oz average that UK market research company and autocatalyst manufacturer Johnson Matthey said was likely for the first half of 2014.

Magara has some decisions to make therefore.

The K4 shaft is required as a means of replacing depleted production ounces in about four years time and given that ramp-up of the project could be between three to four years, it will mean an investment decision will be required in the next 12 to 18 months.