[miningmx.com] – ZIMBABWE is working towards lowering the royalty for platinum miners after producers complained of excessive revenue contributions to the government in light of softer commodity prices on world markets.

Finance minister, Patrick Chinamasa, recently announced a cut to the gold royalty from 7% to 5% to help the gold sector increase production to 15 tonnes required for re-admission into the London Bullion Exchange.

He told Zimbabwean parliamentarians on Wednesday that it was important to balance the royalty rate for platinum and the platinum price.

The mineral rich southern African country currently levies 10% royalty on platinum miners which include units of Impala Platinum, Anglo Platinum and Aquarius Platinum.

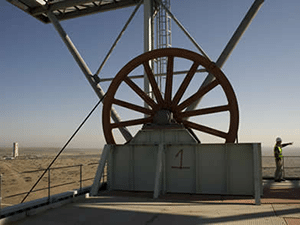

On Tuesday, Zimbabwe and Russian government officials commissioned a $3bn platinum mine in Darwendale.

“The issue of falling commodity prices is of concern to us. It reduces our export receipts and naturally the revenues to the government,” he said.

Gold mining executives have largely welcomed the gold royalty review, although they now want the government to fix the power supply situation.

Zimbabwe’s Chamber of Mines has made intensive representations to the government, complaining of high royalties, excessive taxation and other mining fees, some of which have already been lowered.

“We have to link up what we charge in royalties to falling prices to ensure that mining houses do not collapse,” said Chinamasa.

The Zimbabwean government was now reviewing the royalty regime with a view to lowering some of the levies although he admitted that “this is an exercise that is complex”, he said. The finance ministry would present reviewed mineral royalty structure before parliament soon.

Zimbabwe’s mining sector is now faced with a negative growth of 1.9% for the current year is moving ahead to take over unused mineral claims from investors.

These would likely be given to new investors such as those from Russia and China, the country’s long-standing allies.