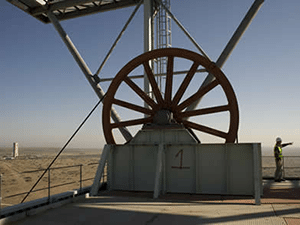

[miningmx.com] – IMPALA Platinum (Impala) unveiled a sweeping restructuring of its flagship Rustenburg (Impala Lease Area) operations which will see it merge and harvest shafts, slow development of another, and halve capital spending.

The end goal is to produce “a more concentrated footprint” at Rustenburg whilst sticking to a 850,000 ounce/year output, a goal it intends to achieve by 2019.

The initiative comes on the back of Implats’ view that the platinum price will be “lower for longer” and in the wake of the five-month industry strike last year which hammered the group’s balance sheet taking net debt to R5.4bn from R3.5bn previously.

The key points of the firm’s strategic review is to complete the build on its 16 and 20 shaft projects which will contribute towards the already announced R30bn in capital spend by 2019. However, Implats will also consolidate mature shafts and mine them out “as fast as possible”.

This is to efficiently generate cash as the shafts – E/F 4, 6, 7, 7A, 8 & 9 – are among the lowest cost operations owing to shallower mining and low capital needs.

Mid-life shafts will be optimised.

There would be no loss of jobs. The company had consulted with unions, including the Association of Mineworkers & Construction Union (AMCU) it which a ‘same do more’ principle to staffing was communicated. A review of staff, due to become available in about three months, would also turn over every position to make sure everyone was “contributing to the bottom line.

In addition, Implats’ other projects and operations will be either iced or sold: the R6.6bn 17 shaft development would be slowed, the Afplats project would be put on hold for four years while the group would look to sell its shares in Marula, an operation that was described as solid but non-core.

The group has also shelved the expansion of its Mimosa in Zimbabwe whilst committing itself to restoring Zimplats to production of 260,000 ounces/year by starting open-cast mining at the operation. Zimplats would also re-develop the Bimha mine whilst it would expand its Two Rivers operation in South Africa.

Commenting on Implats’ market view, Terence Goodlace, CEO of Implats, said: “Above ground stocks are still very vexing, but we have assumed two to 2.5 years [in stocks]. That is what we’re planning assuming that prices remain [at spot]”.

This view differs markedly from that of Anglo American Platinum which said that the platinum market would start to improve during the course of 2015. “There is just not enough clarity on above ground stocks,” insisted Goodlace.

Implats posted reduced profit for the six months ended December 31 of R283m compared to a profit of R922m. Diluted share earnings were down 104 cents to 41c year-on-year. Given that cash on hand fell R1.6bn, and accounting for the depressed state of the market, a decision was taken not to pay the interim dividend for the second year running.

Goodlace said the firm had enough firepower on its balance sheet for the remainder of the year, but it still makes for sober reading with cash of R2.7bn set to be depleted as Implats met its capital commitments this year and kept net debt steady at R5.4bn.

There was also R3bn in uncommitted funds but with the recovery in the market hard to forecast, Implats had set about a cut in capital spending to R4.5bn, down R2.2bn by the 2016 financial year. “We are okay for the foreseeable future, bearing in mind that we are cutting large swathes out of capital,” said Goodlace.

However, the group intends on building on its Impala Refining Services (IRS) processing business, especially in the longer term when junior miners came back into the market, according to Johan Theron, group executive of corporate relations at Implats.

HEADWINDS

A hindrance to capitalising on the spare capacity Implats has at IRS, however, is the risk of power interruptions, and cost increases, from Eskom.

“Mineral processing plant is a concern from an energy point of view,” said Goodlace. “One impact is that it will reduce the life of our refractory linings. We do have flexibility to build another furnace, the framework is there so we just have to put it together,” he said, adding a new furnace build would cost R130m.

Goodlace confirmed that the company’s 50% investment in Mimosa would face a 15% levy on exports from Zimbabwe, a development that he said could “… hit us extremely hard”.

He added that “…the whole business could be at risk if we get lower dollar prices as well for platinum”. As a result, the proposed $70m, 70,000 oz/year expansion of Mimosa, which Implats shares with Aquarius Platinum, had been shelved.

Zimplats, in which Implats has an 87% stake, would be unaffected by the levy.

Analysts, meanwhile, questioned the sustainability of keeping the Rustenberg Lease Area at 850,000 oz/year, a target that has been the subject of scepticism in the past.

“The key question is for how long can Impala sustain production at 850koz if older shafts are mined faster and capital spending at newer shafts are curtailed?,” asked Gerard Engelbrecht, an analyst for Macquarie Research. “We expect production to start declining rapidly around 2024 (all else being equal),” he said.

Allan Cooke, a precious metals analyst at JP Morgan, asked during Implats’ presentation today why unprofitable ounces continued to be mined at the Lease.

Said Goodlace: “We looked at a much smaller Impala, but we came to conclusion that if we went that way the whole mine would [eventually] close”.