[miningmx.com] – Lonmin shares rose nearly 3% to R26.7 in trading on the JSE this morning after the release of interim results but the firmer trend may not last given the unbundling of Glencore’s 23.9% stake in the platinum producer on June 9.

According to JP Morgan Cazenove analysts Allan Cooke and Abhishek Tiwari the distribution of these shares to Glencore’s individual shareholders “may pressure the share price in the second half of 2015.’

The analysts don’t go into detail but the reason is many institutional shareholders in Glencore could consider Lonmin to be non-core – as Glencore management has done – and sell the stock creating a temporary overhang in the market.

The increased trading liquidity plus any marked drop in the already depressed Lonmin share price could set the company up as a takeover target.

According to a research note by the JP Morgan analysts, “Lonmin is one of only three fully integrated platinum producers in the world. We suspect that companies intent on entering the industry might view a potential sell-off of the stock as a rare opportunity. We anticipate a volatile share price this year and maintain our sector-relative Neutral stance.’

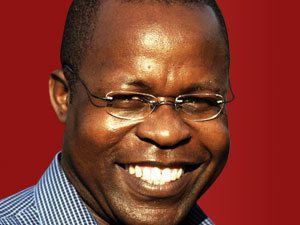

Asked for his views on this scenario at the presentation of Lonmin’s interim results this morning CEO Ben Magara commented, ” there are ifs, ifs and ifs. Management can only work with the factors that it can control and our aim is to have a robust business that is attractive to investors.’

Lonmin reported an underlying loss of 10.5c per share (cps) for the six months to end March (six months to end-March 2014 – 3.5cps profit) which was better than market analyst consensus for a loss of 13.5cps for the period.

Main factor was an inventory build-up of unprocessed concentrates amounting to $124m because of the problems that shut down the Number One furnace last year. The furnace returned to operation on March 9 and management expects to catch up on the smelting backlog during the second half of the 2015 financial year.

But the smelting hiccup helped push net debt at end-March to $282m (September 14 – R29m). According to the JP Morgan analysts, “management indicated that if the group had refined and sold all metal produced during the half, net debt would have been lower by around $170m – at $112m – implying that its operations would have been break-even at the operating level (before capex) for the half. “

Magara said Lonmin was maintaining production guidance for financial 2015 at 750,000oz of platinum while cutting capex to $160m for 2015 and dropping it again to $150m for each of the 2016 and 2017 financial years.

He commented, “platinum metal prices will be lower for longer and these lower prices will persist for at least two more years’.

In addition to the capex cuts Lonmin is also planning to reduce its work force by some 3,500 people in order to cope.

The JP Morgan analysts comment, “Lonmin is burning around $105m per year at spot PGM (platinum group metal) prices and rand/dollar exchange rates basis management’s financial year 2015 guidance.’

According to UK securities firm Numis, Lonmin had reported, “a weak set of numbers, slightly better than market expectations. The balance sheet looks pretty ugly but should see some reversal in the second half. Making some progress in a tough operating environment but still work to do here.’