[miningmx.com] – ATLATSA Resources is to close two shafts and cut jobs at its 120,000 ounce a year Bokoni Platinum Mine as part of a plan with its joint venture partner, Anglo American Platinum (Amplats), to keep the company afloat.

The firm, which owns 51% of Bokoni Platinum Mines, said it had issued a Section 189A notice to unions ahead of offering voluntary severance and early retirement packages for employees affected by the closures. The 60-day consultation process with unions was anticipated to end on November 16, it said.

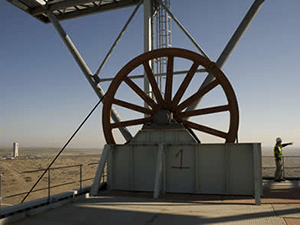

“Implementation of the restructure plan at Bokoni Mine is anticipated to result in the older, high cost UM2 and Vertical Merensky shaft operations being placed on care and maintenance,” the company said in an announcement to the JSE.

It added that its key Middelpunt Hill UG2 and Brakfontein Merensky underground operations would press ahead with their 2016 and 2019 commissioning dates, although the firm acknowledged ramp-up had been slower than planned.

“Given various operational and market related challenges experienced during the ramp up phase of the two operations, Bokoni Mine has had to ensure that its older, higher cost Merensky operations at the vertical and UM2 shafts remained operational for longer than originally contemplated, a position which is no longer sustainable in light of limited available ore reserves remaining at these shaft operations and continued depressed platinum group metal (PGM) prices,” Atlatsa said.

“The primary objective of the restructure plan is to enable Bokoni Mine to endure a prolonged period of depressed PGM commodity prices, by reducing its existing cost structure, and increasing production volumes of higher grade ore from underground operations,” it said.

Amplats CEO, Chris Griffith, said on September 9 that it would refinance Atlatsa Resources for a fourth time before selling its 49% stake in Bokoni Mines. “There will be a further refinancing [of Atlatsa] to get us through this period,” said Griffith.

“We need to focus on what would make it [Bokoni] profitable. We are firmly of the view that we would do the right thing. We are very engaged with them [Atlatsa] and we will continue to do the right thing until the very last day we are associated with it,” he said.

The company would also continue mining at the Klipfontein Merensky open-cast operation as a mill gap filler during ramp up of the underground operations, it said.

Last year, Amplats and Atlatsa agreed a new financial structure – the third since about 2008 when the Atlatsa empowerment deal was first announced – in which Atlatsa sold mineral rights back to Amplats for $171m, cut debt 75% to $150m, and reduced the interest bill on the outstanding debt.

And then in July, Atlatsa announced that some C$42.4m (R437m) in financial support from Amplats which was intended to tide Bokoni Mines over until 2016 amid a period of capital expenditure, had failed – an event that raised questions over Atlatsa’s viability. Bokoni Mines is situated in the northern part of the Bushveld Complex.