EASTERN Platinum (Eastplats) is to sell its Crocodile River Mine (CRM) to China’s Hebei Zhongheng Tianda Platinum Company (HZT) in a $50m deal that doubles the Toronto- and Johannesburg-listed platinum firm’s cash balance.

HZT is not connected to Hebei Zhongbo Platinum Company, another Chinese company that in 2015 launched a $225m takeover bid for Eastplats. That takeover proposal unravelled last year owing to a dispute with the bidder’s shareholder.

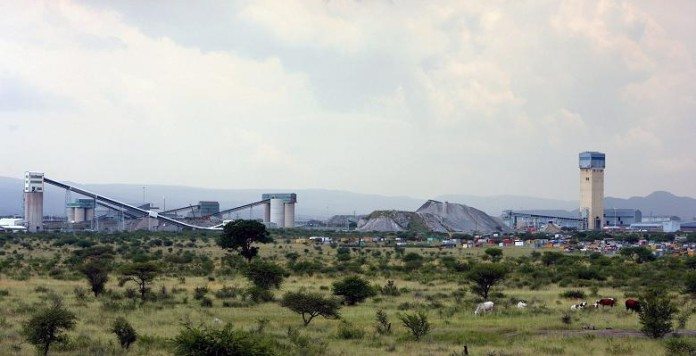

In terms of the CRM transaction structure unveiled today, HZT will buy Eastplats’ subsidiary, Barplats Mines, which controls CRM – a mine that produced annualised production of 152,000 ounces in the September quarter of 2010 before it was shut in 2012 amid declining platinum group metal (PGM) prices.

CRM has had a volatile operating history. It was closed in 2001 and again in 2003 before a re-opening in 2004. CRM was an asset in Cypriot mining entrepreneur Loucas Pouroulis’s Lefkochrysos (White Gold) in 1987.

Eastplats, which appears to be the subject of an attempted board coup, will continue to maintain ownership of its Eastern Limb projects, which include the Mareesburg, Spitzkop and Kennedy’s Vale projects.

David Cohen, chairman of Eastplats, said he was pleased HZT would “… inject foreign capital” into South Africa which would help job creation in the Brits area, where CRM is located.

“We will retain our large and shallow eastern limb PGM project base. While the PGM sector remains under pressure, closing the transaction will leave Eastplats extremely well capitalised,” he said. Eastplats said in a letter to shareholders on May 30 that it had more than $52m in cash and cash equivalents as of March 30, 2016.

The primary purpose of the letter was to head off a likely board coup by Ka An Development Company, a Chinese firm that has been building a position in Eastplats.

As per Eastplats’ letter to shareholders in May, Ka An Development Company had bought $15m worth of Eastplats shares – about 12.8 million equal to 13.79% of the company.

A Toronto-based hedge fund, K2 Principal Fund, has also been connected with a possible coup, but of the two so-called ‘dissident investors’, only Ka An Development Co. has actually said it wants to replace the Eastplats board with six of its own nominees.

Eastplats’ Cohen has since delivered a potentially crippling volley at the dissidents, in which he detailed the colourful track-records of the principal members behind Ka An Development Copmany which, he said, proved they were not the right people to take the company forward.

Eastplats annual general meeting, in which it is expected the conflict with Eastplats’ ‘dissident investors’ will be decided has been scheduled for July 5.

In respect of the CMR deal, the cash payment for the mine will be net of transaction costs, including amounts payable to certain minority interests, which amounts remain to be determined, Eastplats said.

A break-fee of $10m is payable should the proposed transaction fail to clear regulatory clearances and obligations. The transaction is expected to close within six months, said Eastplats.