[miningmx.com] — DE BEERS said on Monday it has “no knowledge” of weekend reports out of London that its 45% shareholder Anglo American was plotting a takeover.

James Wyatt-Tilby, spokesperson for Anglo American, one of the world’s largest mining companies, told I-Net Bridge that the company would “not comment on this speculation”.

De Beers spokesperson Tom Tweedy also called the report “speculation”, as the company had no knowledge of a takeover plan.

“It is a shareholder issue – only shareholders would comment,” he added.

The reports emanated from the Sunday Times in London, which said Anglo is considering a plan to take control of De Beers.

The London-based company, which has significant mining operations in South Africa, would do so by buying out the Oppenheimer family’s stake, said the report, which cited sources in London’s financial district.

Anglo American owns 45% of De Beers, with the Oppenheimers holding 40% and the government of Botswana 15%.

The deal could cost Anglo American at least £2bn, the report said.

“Shareholders aren’t happy with the minority investment. They want clarity either way, and the view of the directors is a positive one: that they would be interested in taking control,” the newspaper cited a banking source as saying.

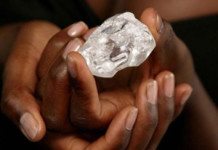

De Beers has expertise in exploration, mining and marketing of diamonds. De Beers has mining operations in Canada, Botswana, Namibia and South Africa, as well as marketing and corporate offices in the United Kingdom and retail stores worldwide.

De Beers de-listed in 2001 after shareholders agreed to a $36bn buyout of the diamond mining giant. This year, it denied reports it may consider a re-listing.