[miningmx.com] – IT’S not often that today’s mining companies offer bonanza-style turns in fortune as the emphasis tends to fall on consistency and predictability of production and results, especially for institutional shareholders who don’t prefer suprises.

One of the few class of mining shares where “the lucky packet’ factor still exists, however, is among diamond miners; especially those that operate mines with resources where the discovery of extremely high value stones is a possibility.

Gem Diamonds, the UK-listed diamond miner that operates Lesotho’s Letseng mine, is one while the most famous of the high value mines must be the Klipspringer mine owned by SouthernEra, a mining company that was once listed in Toronto. The value of stones from that mine were so amazing that they paid for the capital of the mine in a matter of months.

Another of these high value diamonds mines is now owned by Petra Diamonds. The UK-lsited firm, run by CEO Johan Dippenaar, has founded a well-respected business by buying up the mines that De Beers could no longer operate successfully.

What’s interesting about these shares is that the delivery of a high value diamond can give a massive boost to the company’s financial standing if not give an entirely new complexion to the financial year.

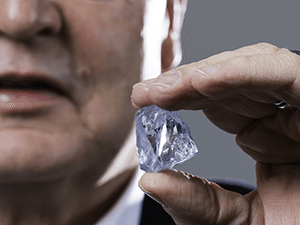

So it is that Petra Diamonds announced earlier this month the discovery of a 122.5 carat (ct) blue diamond at its Cullinan mine – a discovery that should, in one sense, be no great surprise. Under its former name of Premier diamond mine, the Gauteng operation is most famous for the diamonds that now sit in the British Crown Jewels – the 530 carat Great Star of Africa and the 317 carat Lesser Start of Africa.

According to Des Kilalea, an analyst for RBC Capital Markets, the 122.5 blue diamond is worth $10m in revenue to Petra Diamonds, equal to $82,000 per carat. “We believe this level is very conservative,’ he said.

Investec Securities thinks the stone could be worth much more since the last special stone discovered of this ilk was a 29.6 ct exceptional blue stone which sold for $26m.

“Looking at the pictures (see pic) the latest stone doesn’t appear to be as vivid so we cannot be sure that it can attain the same value per carat, but even if it’s a quarter of the value per carat it could still be worth around $26m,’ it said.

According to Investec, the stone is therefore worth 5 cents a share, or around 3 cents post-tax earnings. On a revenue basis, at $26m, the stone is some 10% of last year’s entire revenue in the nine months to end-March, and 7.5% of this year’s revenue year-to-date of $349m.

“This is great news for Petra as exceptional stones provide a meaningful contribution to the company’s bottom line as Cullinan’s run-of-mine grade is $150/ct,’ said Numis Securities, a UK brokerage, in a note.

Recent large stone discoveries at Cullinan by Petra Diamonds suggest the latest find is significant. In 2008, Petra sold a 39.9 ct blue diamond for $8.8m and in 2013 a 25.5 ct diamond was sold for $16.9m followed by a 29.6 ct piece in February which sold for $25.6m.

The highest price for a gemstone at an auction was Petra’s 26.6 ct fancy blue flawless diamond – which boiled down to seven carats once it had been polished – which sold for $9.5m.

Analysts warn, however, that stone quality is everything so they can’t jump to conclusions until the stone is properly analysed, a process that also means the sale of the gem, and revenue, won’t be booked until Petra’s next financial year which starts tomorrow (July 1).