COBALT Holdings is set to launch an initial public offering (IPO) on the London Stock Exchange in June, targeting a strategic position in the clean energy market, according to a Financial Times report.

The commodities investment company aims to raise approximately $230m, with global trading giant Glencore and investment firm Anchorage taking a combined 20.5% stake in the venture. Glencore will hold a 10% share in the company.

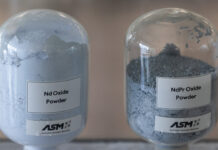

Led by Jake Greenberg, Cobalt Holdings is positioning itself as an investment vehicle modeled after Yellow Cake, a London-listed company that focuses on uranium holdings, said the newspaper. The firm’s unique approach involves purchasing and holding physical cobalt, offering investors direct exposure to the metal’s price without the complexities of mining operations, it added.

A key highlight of the listing is a six-year supply contract with Glencore, which includes an initial $200m purchase of 6,000 tons of cobalt at a discounted rate. This represents roughly a third of the world’s projected excess cobalt supply in 2025.

The timing comes amid challenging market conditions, with cobalt prices plummeting from nearly $40 per pound in 2022 to around $11 this year. The Democratic Republic of Congo, the world’s largest cobalt producer, has even implemented a temporary export ban to stabilise prices.

Greenberg emphasised the company’s mission to provide a low-risk, low-cost investment model for equity investors interested in cobalt’s potential growth, particularly in the evolving clean energy sector.