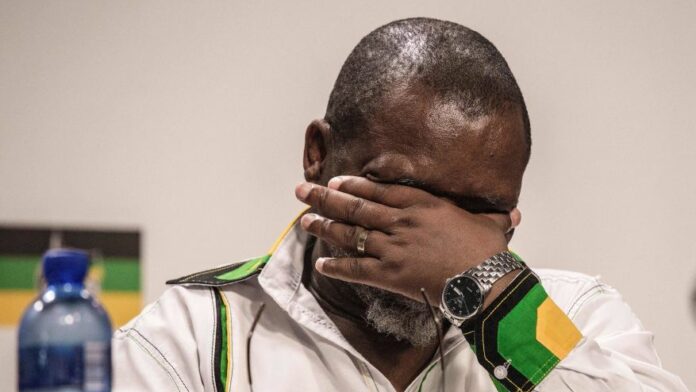

SOUTH African mines minister Gwede Mantashe’s proposal to withhold mineral exports to the US in retaliation for 30% across-the-board import tariffs was described by analysts in a recent article by News24 as a foolish act of self-harm by analysts.

Mantashe repeatedly suggested blocking mineral shipments as leverage against Washington’s threatened trade measures which are to be implemented as proposed – 30% tariffs excepting minerals such as gold and platinum group metals.

Speaking at the Mining Indaba months ago, the minister initially proposed withholding exports in response to reduced American foreign aid to South Africa and the broader African continent. He reiterated this stance during a G20 critical minerals stakeholder meeting, advocating for alternative markets should President Donald Trump’s administration impose the threatened levies, said News24.

The US remains South Africa’s largest PGM export destination, importing nearly R50bn worth in 2024, said News24. America’s automotive industry depends heavily on these materials for catalytic converters controlling vehicle emissions, it said.

South Africa dominates global PGM resources, supplying 80% of worldwide production except palladium, where it accounts for 36% of global supply.

Donald MacKay of XA Global Trade Advisors told News24 the strategy would backfire spectacularly. He noted that whilst large economies like China might successfully employ such tactics, smaller economies risk severe self-inflicted damage.

“If we use that leverage and tell the US we’re not sending platinum, it would affect our mining companies very badly,” MacKay cautioned, adding America’s retaliatory capacity far exceeds South Africa’s.

The practical complexities of restricting exports further complicate matters, as South African PGM producers sell directly to catalyst manufacturers like Johnson Matthey and Umicore operating across multiple countries rather than to governments.

Investment analyst Robbie Proctor of Anchor Capital explained that preventing US exports would require either global cessation of PGM sales or restricting transactions exclusively to Chinese manufacturers.

EY partner Duane Newman dismissed the proposal as nonsensical without local processing alternatives, questioning the logic of withholding resources simply because “we’ve got them and others don’t”.