IT’S not only the gold price that is setting new records. The fundamentals supporting the gold market, as set out in the World Gold Council’s (WGC) 2025 Gold Demand Trend report, are also reflecting the buoyant conditions for bullion.

The report by the industry body, released today, shows that the London gold price set 53 new all-time highs during 2025, with the price advancing 64% and the annual average price of $3,431/oz at its highest level ever.

Since year-end, the price has rallied by a further 20% to around $5,300/oz fuelled by safe haven demands on the back of US President Donald Trump’s attacks on the US Federal Reserve’s independence, military intervention in Venezuela and, possibly in Iran, and the threats to annex Greenland.

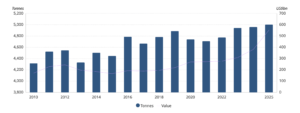

How is this reflected in the market fundamentals? On the demand side, the WGC figures show that total gold demand exceeded 5,000 tons for the first time in 2025, up 1% for the year. But, given the gold price surge, “this yielded an unprecedented value of $555bn, up 45%”.

Leading the growth in demand were gold-backed Exchange-Traded Funds (ETFs) who bought a record 4,025t of gold in 2025, much of it in the fourth quarter. More than half the increase in global annual ETF demand was funnelled into North American funds, highlighting that US fund managers too are worried about the geo-political and economic impacts of their government’s policies.

Net central bank gold demand was a sizeable 863t in 2025, though short of the +1,000t level seen over the preceding three years. On the downside, and as expected in the high price environment, physical jewellery demand fell by 16%.

Click to expand graph below.

The WGC says prospects for continued investment remain positive, “given continued geopolitical tensions and simmering concerns over US Fed independence and the path of US interest rates. Furthermore, stretched equity market valuations highlight the need for effective portfolio diversifiers.”

Total gold supply in 2025 increased 1% to 5,002t, the highest in the WGC’s annual data series dating back to 1970, driven by increased recycling as well as record mine output. The WGC’s current estimates suggest that mine production posted a marginal gain in 2025, up 1% to 3,672t and just surpassing the 3,663t record set in 2018.

Mine production growth should not be overstated says the WGC: “Although there is potential for more gains in 2026, the average annual growth in mine production over the past ten years is less than 1% and it will be challenging for the industry to increase output in the short term.”