Northam strike ends as NUM accepts 9.5%

The National Union of Mineworkers accepted a wage offer of between 8.5% to 9.5% from Northam Platinum bringing a 75-day strike at Zondereinde to a close.

CEOs for whom 2014 is ‘stand & deliver’

2014 is expected to be another tough year for all miners, but for some it will be a defining year when they either delivered or failed shareholders. Here's why.

Royalties may shut 75% of Zimbabwe gold sector

Royalties could make three-quarters of Zimbabwe's gold sector unviable, said the country's Chamber of Mines which called for sweeping policy changes this year.

SA gold firms may re-rate as Rand assists

Gold shares were currently receiving a basket price in line with the gold boom in 2011 which could lead to some surprise fourth quarter figures.

AMCU tells miners to expect strikes in a week

The Association of Mineworkers & Construction Union said strike notices would be issued in a week and said industrial action would be extended to the gold mines.

NUM spurns Northam 9.5% wage deal

The National Union of Mineworkers said it would issue a counter-proposal of its own after rejecting the latest increase in wages by Northam Platinum.

Hopes kindled for Northam, NUM settlement

Yet the turmoil is far from over in South Africa's platinum sector as the signs are that AMCU is gearing up for strikes at all three major platinum miners in February.

Forbes Coal’s Theron booted in $19m ouster

CEO, Stephan Theron, is to step down from the company as shareholder Resource Capital Fund re-capitalises the company in an effective takeover.

Glimmer of hope for cash-strapped ContiCoal

Continental Coal said it had made progress in discussions with bondholders over the recapitalisation of the business.

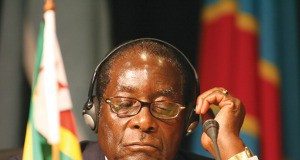

Mugabe will make final call on PGM refinery

It would be left to Zimbabwean president Robert Mugabe and his coterie of close advisors to decide whether the country should have a platinum refinery in short order.