TRANS Hex is to put its unprofitable West Coast Resources (WCR) into liquidation following a one third decline in diamond prices this year, said BusinessLive.

Citing an announcement to the Johannesburg Stock Exchange on October 18, BusinessLive said Trans Hex had applied to the High Court in Cape Town to wind up WCR. It had previously failed to sell the business or to get a third party to run it. Shares in Trans Hex were 70% down in the past five years.

“WCR is not in a position to meet its working-capital requirements without the necessary funding being made available to WCR,” said Trans Hex. “Accordingly, shareholders are advised that the major shareholder of WCR … today lodged an application to the high court [Western Cape division] for WCR to be placed into provisional liquidation”.

Trans Hex bought WCR five years ago and intended to give it a new lease on life after the depletion of diamonds at two flagship mines on the banks of the Orange River. But a combination of falling diamond prices and lower than expected grades of diamonds from WCR rendered the business commercially unsound, said BusinessLive.

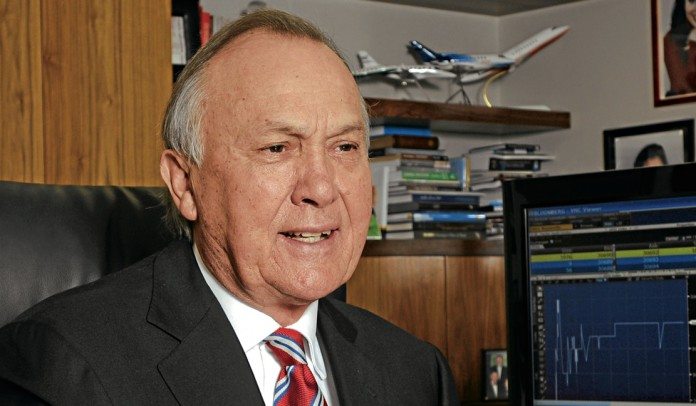

The liquidation means another headache for Christo Wiese, a South African businessman, whose reputation as one of the country’s most respected stewards of shareholder capital was tarnished with the near collapse of retailer, Steinhoff.

Wiese is also in the middle of reviving investment group Brait, which buckled under the weight of weak consumer demand in the UK after an ill-fated acquisition of the British high street retailer New Look, said BusinessLive.