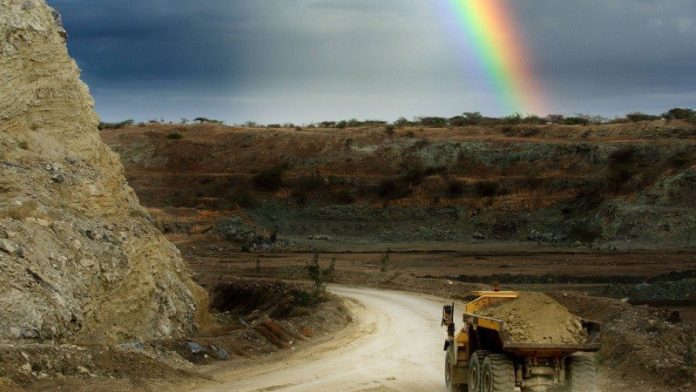

PETRA Diamonds has agreed to pay £4.3m in settlement of claims brought against the company’s Williamson mine in Tanzania in respect of human rights abuses perpetrated by a third party security company hired by the miner.

Following an internal investigation, the company has also restructured its reporting lines in order to improve oversight of Williamson, a mine that has been in mothballs for over a year following a slump in the diamond market.

According to Leigh Day, the UK attorney, claims were brought against the company by 71 anonymous individuals who alleged that they suffered serious human rights abuses by security personnel employed by Petra. The violence that broke out as security sought to keep the miners from the mine, resulting in the loss of life.

“The board regrets the loss of life, injury and mistreatment that appears to have taken place around the mine,” said Peter Hill, Petra’s chairman. “The agreement reached with the claimants, combined with the other actions put in place, are aimed at providing redress and preventing the possibility of future incidents,” he said.

In addition to compensating the claimants affected by the violence, the settlement also accounts for community-focused initiatives Petra has agreed to undertake. These involve “… providing long-term sustainable support to the communities living around the mine,” the company said.

The settlement does not include potential compensation that could be paid to up to 25 additional potential claimants who have come forward during the final stages of the settlement negotiations, said the company.

The settlement was conducted on the basis of a no admission of liability basis. Petra owns 75% of Williamson whilst the Tanzanian government owns the balance.

Despite the possibility of the additional liabilities, the out of court settlement – in which Petra calculated it would be unable to recover its legal fees – closes the book on a period of major corporate turbulence for the company. Last year, it agreed to issue about 95% of its share capital in order to refinance its heavily levered balance sheet amid disappointing production numbers and a decline in the diamond market exacerbated by Covid-19.

The agreement with the Tanzanian claimants is also expected to pre-figure the reopening of Williamson just as the diamond market shows signs of sustained recovery. Raj Ray, an analyst for BMO Capital Markets, said in a note today Williamson could recommence mining in January 2022.

“On a like-for-like basis, we are confident Williamson would be cash generative,” said Jacques Breytenbach in response to questions during a presentation of the firm’s third quarter trading update on April 20.

Breytenbach said at the time that Petra was “pushing to complete agreements” with the Tanzanian government in the fourth quarter regarding outstanding VAT payments of as much as $15m as Williamson’s cash balance was running low.

The mine was burning $800,000 to $850,000 a month in cash whilst in mothballs. Its restart to full production could take up to three months requiring $20m in working capital, said Breytenbach.