LUCAPA Diamond Company is to buy the Merlin diamond mine for A$8.5m which it will finance through the issue of shares.

Lucapa said in an announcement today that the project had potential to become Australia’s only diamond producer following the closure last year of Rio Tinto’s Argyle mine. The transaction also represents diversification from Lucapa’s existing assets in Lesotho and Anglola although some proceeds from the share issue will be used to fund exploration at Lulo.

“This is a strategic acquisition for Lucapa which represents a value-accretive and logical step in Lucapa’s production strategy,” said Stephen Wetherall, MD of Lucapa. “The project is well known for being Australia’s large stone producer and is a strong complementary fit with the company’s two existing niche productions in Africa that are set to produce solid returns for Lucapa in 2021.”

In addition to Lulo in Angola, Lucapa operates the Lesotho diamond Mothae which was reopened in January following a national Covid-19 lockdown.

Lucapa will raise A$20m in a two-tranche placement of shares priced at five Australian cents per share – a 9.1% discount to Lucapa’s May 19 close when trading was suspended by its own request. Lucapa said the first tranche was “… well supported by several new and existing institutional shareholders”. The second tranche was yet to receive shareholder approval. It then would issue a further A$3m from eligible shareholders.

In November, the company raised $10m through a share issue with the proceeds primarily to be directed to the $8.5m expansion of its Mothae.

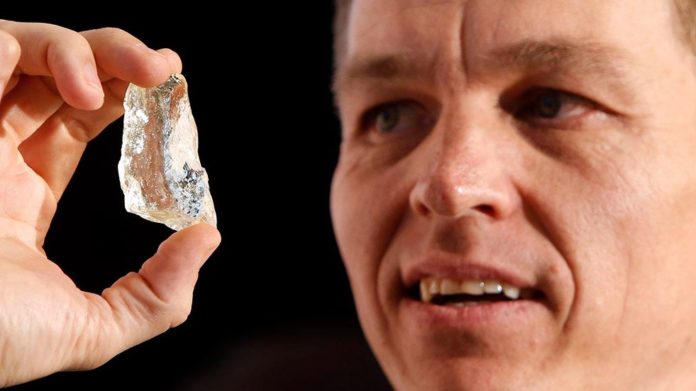

The proceeds from the latest capital raising would be allocated predominantly to the feasibility study of the Merlin mine which yielded Australia’s largest mined rough diamond on record, according to Lucapa. The mine, previously worked by Ashton Diamonds and Rio Tinto, is located in Australia’s Northern Territory. Between 1999 and 2003, some 500,000 carats were produced from 2.2 million tonnes of kimberlite processed. The mine has a JORC-compliant resource of 4.4 million carats, said Lucapa.

“We look forward to getting on the ground, completing the work to deliver the various studies and bringing Merlin into production as soon as possible,” said Wetherall.

Lucapa’s aggressive expansion strategy comes against a backdrop of a weak share price after trading at double the level of the share issue at the beginning of 2020. This is notwithstanding a recovery in the diamond market since year-end.

Commenting on De Beers’ fourth cycle sales of 380m, Goldman Sachs said there was “… ongoing demand recovery and at higher diamond prices versus 2020.”

Bloomberg quoted Liberum Capital analyst Ben Davis as saying in April that Alrosa and De Beers had managed to clear the excess rough diamond inventories built over the course of 2020 and without hurting polished-diamond pricing that continues to advance.

“This bodes very well for the remainder of the year to clear that much stock in such a short space of time,” Davis said.