Gem Diamonds has granted an extension over the sale of its mothballed Ghagoo mine in central Botswana as the potential buyers – Okwa Diamonds and Botswana Diamonds (BOD) – struggle to find the finance.

Okwa and London-listed Botswana Diamonds bought the Ghaghoo mine for a knock-down price of $4m in August last year in a JV with Vast Resources which was supposed to put up an initial $15m in funding to bring the mine back into production.

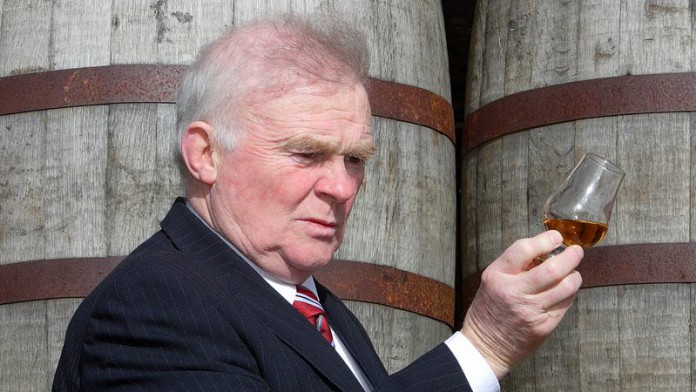

BOD had a 10% free carried interest and BOD chairman John Teeling made it clear that BOD had no intention of kicking in any present or future funding on re-opening the mine.

But, in early February, Vast pulled out of the Ghagoo deal with no reasons given by either Vast or BOD although analysts pointed out that Ghagoo was a deeply flawed operation with major obvious problems.

Gem Diamonds bought Ghagoo – then called Gope – from De Beers in 2007 and spent some $85m developing the mine which came into operation in 2015. Ghagoo was shut down in February 2017 with the reasons being poor diamond market conditions and operational problems.

Analysts had commented from the beginning that those problems included Ghagoo’s location in a remote part of the Central Kalahari and the fact that the diamond-bearing kimberlite pipe was covered by sand some 80m deep. That ruled out traditional opencast mining methods so Gem developed a decline shaft which in turn triggered further problems because of the difficult ground conditions.

BOD’s own assessment of the current situation appears negative. The mine is flooded and there is also a sinkhole “caused by the partial collapse of a portion of the crown pillar possibly due to overmining” which limits access to a high-grade zone.

Despite all this Teeling and BOD MD James Campbell were optimistic on getting the mine back into production but clearly using somebody’s else’s money.

Gem – which has been trying to sell Ghagoo without success since it shut it down – has now agreed to extend the “long stop” date of March 31 for the acquisition of the mine by Okwa/BOD to May 10 as Teeling aims to “finalise discussions with interested financiers.”.

Gem’s only operating mine is Letseng in Botswana and the company had net cash of $20.2m at end-March some of which it is now using for a share buy-back scheme intended to purchase up to $2m of its shares. Gem shares are currently trading around 62p on the London Stock Exchange after trading as high as £11 in 2008/2009.