DE BEERS has attracted interest from at least six consortia, including commodities billionaire Anil Agarwal, Indian diamond firms and Qatari investment funds, Reuters reported in an article published on June 6.

As Anglo American pivots towards its core copper and iron ore assets, it is divesting De Beers, though the move is complicated by a slump in global diamond prices.

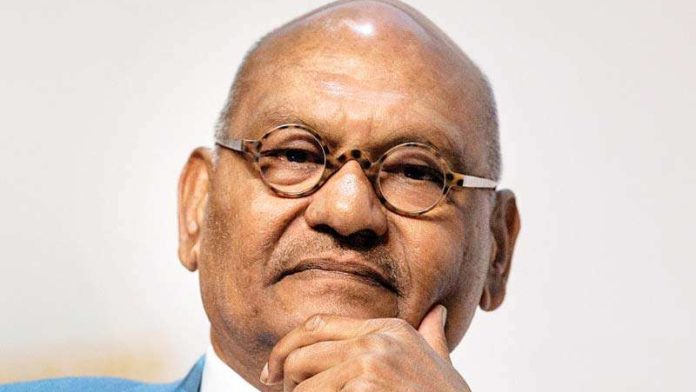

Agarwal, chairman of Vedanta Resources, is among the interested parties as part of a larger group, sources said. In 2017, he became Anglo’s largest shareholder with nearly 20%, exiting two years later after the share price doubled.

Indian companies KGK Group and Kapu Gems, which dominate domestic cutting and polishing and are De Beers’ biggest customers, have also expressed interest as part of larger groups.

Former De Beers CEO Gareth Penny is assembling a consortium backed by a Qatari investment fund, sources said. Although Qatar’s QIA sovereign wealth fund decided against bidding, other Qatari funds Mayhoola For Investments and Al Mirqab Capital remain interested, said Reuters.

Separately, Botswana’s government, which owns 15% of De Beers and supplies 70% of its rough diamond production, is considering increasing its stake.

Anglo American values De Beers at $4.9bn after recording $3.5bn in impairments over two years. However, consensus value sits around $3bn due to the diamond market slump, with prices falling 35% from early 2022 highs due to changing consumer preferences and lab-grown gems.

Anglo chief executive Duncan Wanblad said plans to divest De Beers “would be substantively complete” by end-2025, with a trade sale preferable to an IPO which wouldn’t happen until mid-2026.