[miningmx.com] – KUMBA Iron Ore, the Anglo American subsidiary, is to lay off some 2,633 employees and 1,300 contractors at its Sishen mine in the Northern Cape in an effort to make profits amid rock bottom iron ore prices.

The prospect of retrenchments was discussed between Kumba and the National Union of Mineworkers (NUM) last week. NUM’s secretary-general, David Sipunzi, described talks as an attempt by Kumba to try to “… sensitise us to this possibility”, according to a report by Reuters.

Kumba today announced a section 189 consultation process in terms of the Labour Relations Act over the retrenchments which it said were necessary because of “sharply lower iron ore prices and both increased capital costs and increased operating expenses due to the current high waste stripping requirements.”

Kumba added: “The new Sishen mine plan significantly reduces mining and production activities and necessitates a re-evaluation of the equipment and workforce needed to support a smaller, more focussed operation.”

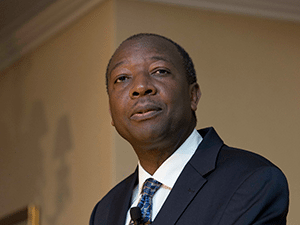

Kumba CEO, Norman Mbazima, commented: “This has been an extremely difficult decision but, after exhausting all other avenues and doing all we could have done to reduce costs, we have no choice but to take more significant steps to preserve the viability of the mine”.

Workers at Kumba have had a roller-coaster ride linked to the latest commodity cycle because – in December 2011 – 6,208 employees each received an after-tax payout of R345,627 when the group’s first broad-based employee equity share scheme matured.

That was on top of each employee having already received up to R55,000 over the previous five years through payouts in terms of the scheme.

Despite this financial windfall, operations at the Sishen mine had to be suspended in October 2012 when some 300 employees staged an illegal strike and blocked access to the open pit mining operations.

The response to the announcement was muted with Kumba shares firming slightly on the JSE, but some analysts remaining negative on prospects.

Investors in Kumba have also experienced fluctuating fortunes as the share surged to above R600 early in 2013 before plunging to an all-time low of R24.15 earlier this month from which it has recovered slightly to current levels around R33.

A research note published by Goldman Sachs commented: “We continue to believe at spot iron ore prices the company will continue to burn cash and await further details of the on-going restructuring process.”

Kumba today also published production results for the quarter – and full year – to end December showing full-year output of 44.9 million tonnes (mt), as forecast, with lower output from Sishen in the December quarter put down to the restructuring already underway.

Sishen’s output dropped 17% quarter-on-quarter to 7.7mt as production was hit by a lack of exposed high-quality ore for blending purposes “as the mine transitions to the lower cost pit configuration”.