Cash-strapped vanadium producer Bushveld Minerals may have to suspend operations because of a liquidity crunch and must secure further funding in the coming weeks to avoid this.

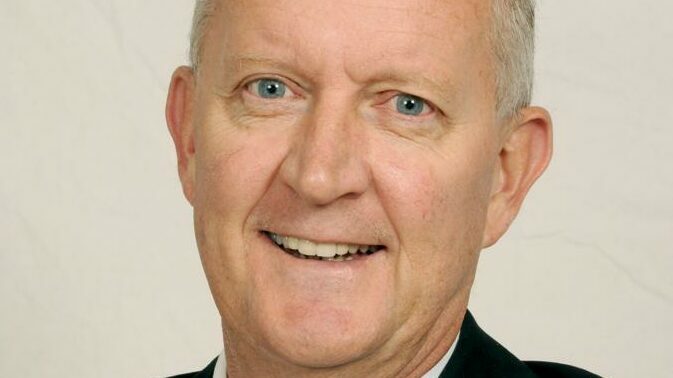

Bushveld CEO Craig Coltman commented Bushveld’s “extremely tight” working capital position had also been made worse by weaker vanadium prices which had dropped between 10% and 17% to date across different markets.

Bushveld completed two corporate deals last year aimed at dealing with its funding situation but one has been delayed and the other appears to have collapsed.

According to Coltman, Acacia Resources was due to settle its subscription for equity of $3.5m by February 28 but has not done so “to date”. Bushveld reported on February 29 that Acacia had requested a further two-month extension to settle the investment which was denied.

Coltman said Acacia was in breach of the terms of the subscription letter which it signed with Bushveld on November 30 last year and that, “the company has instructed its lawyers to commence legal proceedings against Acacia.”

The second deal involved a sale of assets to investment fund Southern Point Resources (SPR) which in October agreed to buy a 50% stake in the Vanchem vanadium processing plant for up to $21.3m and a 64% stake in a Bushveld subsidiary that owns the Mokopane vanadium project for $3.7m.

The deal included an equity investment tranche in Bushveld by SPR of $12.5m but that was delayed, and Bushveld only received the full amount in the form of non-refundable, interest free loans by March 14.

Coltman said today that completion of the asset sale to SPR has been delayed to July 2024 “at the earliest” instead of the initial forecast of February because the company is waiting for approval from the South African Competition Tribunal.

He added, “due to the delay in receiving funds from Acacia and SPR production has been materially adversely affected in the current quarter, particularly at Vametco.”

Coltman concluded that, “the delay in payments coupled with the weaker realised vanadium prices – now 15% lower than budgeted – has meant that our working capital position is extremely tight.

“However, we continue to engage with all stakeholders to resolve this issue. We will provide 2024 guidance once we have clarity on the funding position.”

Coltman said Bushveld had a closing cash balance of $2.2m as of April 21 and UK brokers SP Angel – which act as broker and Nomad (nominated adviser) to Bushveld – said today that Bushveld will need to repay around $7m due to Orion on June 30 in terms of the latest convertible loan note refinancing completed in February.

Bushveld shares quoted on the London Stock Exchange have collapsed from around 30p five years ago to current levels around 0.7p.