[miningmx.com] – THE $220m restructuring of the 30 million oz Obuasi gold mine in Ghana weighed on AngloGold Ashanti during the second quarter leading the group to a $89m headline loss.

AngloGold Ashanti announced in the previous quarter that it would finally take its medicine at Obuasi putting it on care and maintenance while it engineered a “radical re-think” of its operations. The mine has returned AngloGold a positive cash flow only twice during 10-years of ownership.

It is also closing its Yatela mine in Mali the cost of which, combined with operational redundancies at Obuasi, accounting for the retrenchment of 3,500 people, added some $54m to once-off costs.

On a normalised adjusted headline earnings basis, which takes out extraordinary non-recurring items, the group produced a $76m profit, equating to $67m year-on-year turnaround.

Total group costs moved in the right direction. At $1,060/oz in all-in sustaining costs (AISC), AngloGold Ashanti registered a 19% improvement year-on-year. The company also set down new safety records which is so often traces a clear line to mine efficiencies.

“A good result and an indication that AngloGold appears well on the path of recovery,” said Investec Securities in a note.

A key guide of AngloGold’s performance, however, is the fact it was able to chip away at its net debt which fell to $2.99bn from $3.1bn in the previous quarter as cash flow improved 140% to $336m compared to the second quarter in 2013.

It also continued to work on the balance sheet putting in two new revolving credit facilities of $1bn and A$500m with more favourable conditions.

Asked about the balance sheet, outgoing CFO, Richard Duffy, said the group would “be comfortable” with net debt of $2bn. “We are seeing the benefit of costs coming down and we will continue to look at the portfolio so it can generate sustainable free cash,” he said. Duffy will be replaced in October by Christine Ramon, the former CFO of Sasol.

Venkat has tended to play down further rationalisation of the group’s portfolio sticking to the “all options are on the table” response when asked.

He was quick to gloss Duffy’s comments today saying the reason for installing new RCFs was down to “a volatile gold price environment” which allows the group to keep its options open.

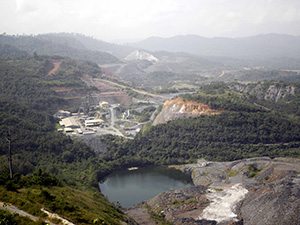

OBUASI

One option is that AngloGold may either sell or joint venture Obuasi once the 18-month restructuring process was complete.

At the moment, the only production from the mine was coming from surface retreatment whilst AngloGold sought to reduce the footprint of the mine to about a third to its southern portion which is where the mine is located.

The plan at Obuasi has been to retrench its entire workforce, including contractors, and then rehire selectively. Venkat, however, was reticent to provide numbers on future production levels or how many people would be rehired.

The bulk of the retrenchment costs was likely to come through in the fourth quarter. Further details would be made known by February at the latest, he said.

In the meantime, a sub-shaft decline had been completed and which would allow an alternative access point for machinery and supplies whereas hitherto all access for employees and supplies has been through the main shaft.

A large portion of employees would be replaced by mechanised mining techniques, including installed ‘jumbos’, multi drill machines that would replace the outdated hand-held drilling techniques currently at use at the mine.

Venkat acknowledged, however, the process was politically sensitive. “The third part of the restructuring is the social and environmental issues. This has been in operation for 100 years so it’s important how we put the social plan together,” he said.

“The broad realisation is that we won’t have an asset if we carry with it as is,” said Stewart Bailey, vice-president of investor relations at AngloGold. “This is a 30 million oz orebody and its high grade. It has got access to power, all the permits, and a workforce. We have got capital sunk in this so let’s do this thing properly,” he said.