[miningmx.com] – GOLD Fields generated more free cash flow in the March quarter and reduced net debt, but it tempered these advances by saying its South Deep mine would produce 10% less gold than forecast for the 2014 financial year.

South Deep, described by Gold Fields today as its most important “value driver”, was in the throes of a conversion to mechanised mining as it seeks to achieve sustainable production of between 650,000 to 700,000 ounces by the end of 2017.

As a result, it had brought in an Australian team of mechanised miners to help with the transition, a process that had been “largely” accepted by the mine’s staff, it said. The work of the team, however, had interrupted production.

Output from South Deep in the 2013 financial year was 302,000 oz, about 12% higher than in 2012. In February, however, Gold Fields lowered the mine’s production forecast and said full production would be delayed a year to accommodate mechanisation. This equated to 2014 production of some 360,000 oz.

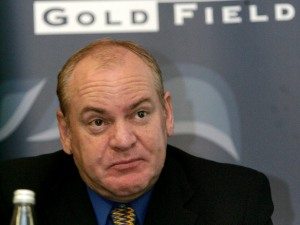

Gold Fields CEO, Nick Holland, said the lower production was owing to “temporary

disruptions and at the expense of short-term momentum in production, destress mining and development …” which was compounded by the Christmas break in the quarter.

“However, we expect that the transformation process will continue to gain traction through the June quarter and should result in greater stability and improved productivity during the second half of the year, which is also characterised by fewer interruptions from public holidays, compared to the first half of the year,” he said.

Holland said in February that it was necessary to more than double South Deep’s levels of gold production in the next four years.

Despite the lower production, Gold Fields was expected to achieve its All-In Sustaining Cost (AISC) guidance for the full year of $1,290/oz and All-In Cost (AIC) guidance of $1,350/oz, said Holland.

Whilst the production adjustment is relatively minor, it may serve reminder that South Deep – which has been subject to countless adjustments in scope and cost over the years – continues to be an uncertain element in the performance of Gold Fields.

In general, however, Gold Fields produced good March quarter figures. Gold production was down owing to South Deep’s engineering challenges, as well as lower output at its Agnew and Lawlers operations in Australia, but its AISC and AIC came in better than it had previously forecast.

The outcome was $21m in normalised earnings which compares to $14m in the December quarter and $68m in earnings in the corresponding quarter of the previous financial year registered before the $200/oz + collapse in the gold price.

For shareholders, this was equal to earnings of 3 US cents per share which compares to 2 US cents per share in the December quarter and 9 US cents per share in the corresponding quarter of the previous financial year.

From an operating cash generation point of view, Gold Fields produced $54m, a 42% increase on the $38m generated in the December quarter. This cash was after taking account of net capital expenditure, environmental payments, debt services costs and non-recurring costs, Gold Fields said.

Holland said the group’s priority was to pay a dividend of between 25% and 35% of

normalised earnings. Gold Fields reduced its net debt by $49m to $1.69bn in the March quarter.