CALEDONIA Mining Corp., the UK-listed gold miner, said it had increased its quarterly dividend 10% to 11 US cents per share in the fourth quarter.

This is Caledonia Mining’s fourth increase in the payout in the last 15 months, and a 60% cumulative increase over the same period.

The company also said it had targeted gold production of between 61,000 to 67,000 ounces for its 2021 financial year. Caledonia Mining operates the Blanket mine in Zimbabwe. The mine is nearing the end of a six-year expansion programme in which annual production will increase to about 80,000 oz from 2022.

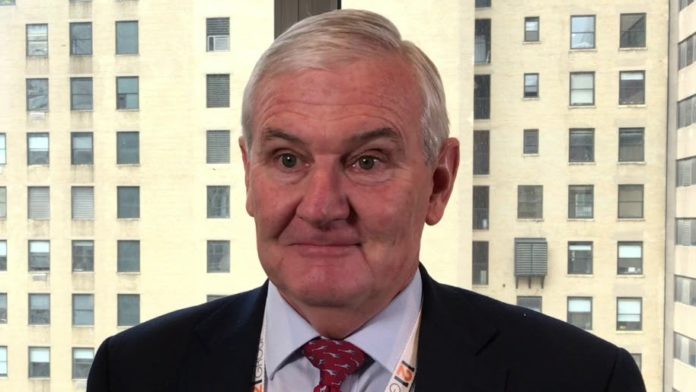

“The decision by the board to increase the dividend reflects our continued and increasing confidence in the outlook for our business,” said Steve Curtis, CEO of Caledonia Mining. “As we reported in our third quarter 2020 results, the business continues to perform well supported by strong production and a firm gold price,” he said.

Caledonia Mining announced on December 17 that it had secured the right to explore a previously worked prospect in Zimbabwe’s Gweru district known as Connemara North. The mine was shut in 2001 by then operator, First Quantum Minerals.

This follows an announcement earlier in December in which the company said it would explore an area known as Glen Hume in Gweru district, paying $2.5m for the option.

Curtis also said there was scope for further increases in the dividend over the next two years as capital expenditure commitments related to Blanket’s expansion, and a rising gold price, increased the firm’s cash generation.

“As we approach the end of the six-year investment programme at Blanket Mine, we expect the combination of rising production and declining capital investment over the next two years will give us the scope to consider further increases in the dividend,” he said. Funds would also be pumped into growing production further, said Curtis.

In November, Curtis said at the Junior Indaba, a conference in Johannesburg: “We recognise that being a single asset company won’t move the needle. We see our way with two or three projects of about 350,000 to 500,000 oz/year”.