[miningmx.com] – WESIZWE Platinum received a $650m capital injection from the China Development Bank which will fund the increased capital expenditure of its Bakubung mine due to produce its first platinum in 2018.

Wesziwe Platinum, which has state-owned Jinchuan Group and the China-Africa Development Fund as its major shareholders, said last year the capital cost of Bakubung would increase R1.4bn to R7.9bn.

The mine, which is expected to operate at a nameplate capacity of 325,000 ounces of platinum group metals by 2023, was on schedule, Wesziwe Platinum said.

“Main commissioning of the mine is scheduled for 2018 and full production is anticipated in 2023,’ the company said in a statement, adding that the project was “progressing well and remains on budget’.

The planned mine is near the city of Rustenburg where Anglo unit Anglo American Platinum last week unveiled plans to close two mines and cut up to 14,000 jobs in a bid to restore profits, Reuters reported.

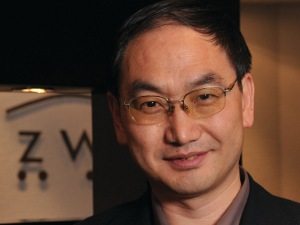

Wesizwe Platinum CEO, Jianke Gao, told Miningmx in December that Bakubung’s capital expenses could increase again before completion of the project.

“Between 2018 and 2023 we may need more finance, especially during the ramp-up period,” he said. “We intend to update the finance requirement on the mine every two to three years,” he added.

Gao also said the company had met with its bankers recently to finance additional funding to retain its 26% stake in Maseve project, a joint venture with neighbour Platinum Group Metals. “We only need $200m to retain a 26% stake so that is not considered too much of a financial burden on finances,” said Gao.