IMPALA Platinum (Implats) is assessing two growth projects that will add 262,000 oz to its annual production – just over 14% of total output – at a potential cost of R10bn.

Nico Muller, CEO of Implats, said in a press call today following the publication of the firm’s interim results, that 180,000 oz in additional (growth) ounces would be produced from each of its Two Rivers joint venture and its 87%-owned Zimplats mine at a capital cost of R10bn over a four to five year period.

“This subject to formal approval,” said Muller, who added a decision was imminent. Of the two projects, some R5.7 would be spent on the Two Rivers project in which Implats has an 46% stake. African Rainbow Minerals is the other joint venture partner in Two Rivers.

On an attributable basis, therefore, Implats would be in for R2.6bn in capex and take 82,800 oz/year in production (but process all of its production at its processing facilities – Impala Refining Services. On Zimplats, Implats is assessing a capital outlay of $290m, equal to R4.43bn.

Implat’s attributable capital outlay for both projects is R7,06bn.

“These are low cost, shallow ounces which is exactly what we are looking at as a company,” said Muller, who added – however – that the group had also strategised for growth through tier one to tier three opportunities.

Whilst the potential new projects were tier one opportunities, Implats was also looking at potential merger and acquisition activity including possible tier three opportunities which would be in battery minerals.

“Impala is interested in investing in its future. We are interested in investing in other parts of the value chain or beyond PGM production in battery metals or associated metals. We would not exclude the possibility of external growth but we won’t grow for the sake of it.”

Asked for details on potential battery metals investment, Muller responded: “Tier three assets may or may not be battery metals.

“I must stress that we are not in a position to make an announcement on this in either the six or 12 months. But we have not excluded it from our universe”.

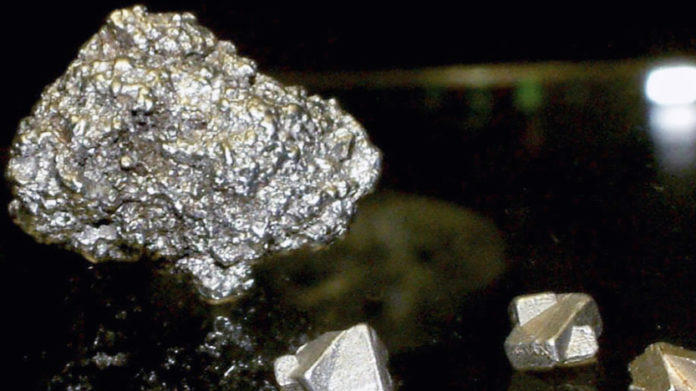

Johan Theron, spokesman for Implats, added that the company already produced nickel, copper and cobalt as a by-product of its platinum, palladium and rhodium production so a move into battery metals would not be a departure.

Taking on meaningful diversification is, however, potentially big news for Implats especially as offshore growth – where much of the battery metals deposits are located – involves high outlay. Sibanye-Stillwater announced earlier this week that it had taken a 30% stake in a Finland lithium project that is hoping to build a R6bn mine.

RECORD DIVIDEND

The main feature of the group’s interim results announcement was the declaration of a R10 per share dividend, equal to R7.9bn in cash payout. This was after raising the dividend ratio to 40% from 30% of free cash flow.

The higher dividend was the fruit of higher refined production, which increased year-on-year 29% to 1.69 million oz, and a significant kickup in rand-denominated pricing. In rand terms, the basket of six PGMs sold by Implats was 71% higher year-on-year at some R35,635/oz.

On a headline basis, interim share earnings came in at 1,855 cents, an increase of 328%. Basic earnings increased to R25.1bn, equal to 3,222c/share from R3.4bn and 439c/share, respectively, in the prior comparable period.

The company said in notes to its interim results that the impact of Covid-19 on platinum group metal (PGM) markets was cyclical rather than structural. In addition, the release of inventory material lately would not stem pricing which would remain “elevated”.

As if to emphasize the point, Russia’s Norilsk Nickel announced that water ingress at two of its mines in its Polar division had resulted in the suspension of production. This division is responsible for palladium production of 1.2 million oz (about 10% of global supply) as well as 302,000 oz in platinum output, equal to 5% of supply.

The market was strong, and with few operational problems experienced in the six months ended December, that Implats was able to reach its previously stated net cash target of R20bn with ease (R20.3bn). This was after capital investment of R2.7bn, an increase of 39% year-on-year.

Operational and market improvements also saw the partial reversal of prior impairments of R14.7bn which resulted in an after tax benefit of R10.6bn in profit of R25.6bn. The increase in refined production was also a result of the six month contribution of Impala Canada.

Implats surprised the market in October 2019 when it swooped on North American Palladium, buying its Lac des Lille mine for R10.4bn. It subsequently said it would pass on a control option over the South African project, Waterberg Joint Venture.

Implats maintained its previously issued guidance for this year of 3.2 to 3.5 million 6E oz in group refined production.