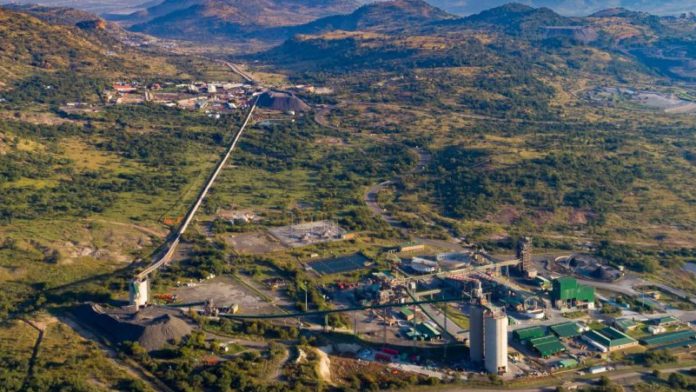

ANGLO American Platinum (Amplats) has approved the extension of its Mototolo mine which is forecast to continue producing 250,000 ounces of platinum group metals (PGMs) for another 30 years.

The Anglo American-owned group said in an announcement today that it had allocated R3.9bn for the project which would see it mine the adjacent Der Brochen property. The project would require the sinking of a new shaft.

Project work would begin in the first quarter of 2022 with first production targeted for the end of 2023. Capital would be deployed over six years with the majority of spend falling between 2022 and 2024. Amplats said the project had an estimated internal rate of return of over 25% with a payback of around six years from first production and assuming consensus pricing.

Natascha Viljoen, CEO of Amplats, said the project was but one example of “… the high quality, low cost expansion options we have available in our existing portfolio of assets”. She also added that work continued on the group’s Mogalakwena project.

Whereas the extension of Mototolo into the Der Brochen farm provides replacement PGM ounces, Mogalakwena will feed new ounces into the PGM market. Viljoen said Amplats was working through five workstreams with a critical phase being the feasibility study into construction of a third concentrator which would continue next year.

No date was put on when the project would be approved disappointing previous expectations of its finalisation by year-end. However, Viljoen said the continued assessment of the third concentrator would not affect progress on some of the other work streams which focus on equally critical issues such as community impact.

Amplats said in February it planned to increase production a fifth to 3.8 million oz of PGMs by 2030. This was in line with bullish forecasts for PGM demand over the next 10 to 15 years.

Refined progress

Amplats also provided an update on its 2021 production numbers and expected production for next year as well as for 2023 and 2024.

Refined production for this year would come out higher than forecast at between five million oz and 5.1 million PGM oz compared to the previous forecast of 4.8 to five million oz as the company worked through inventory built up whilst it was repairing its processing plants in 2020. The company said the majority of the build up had been refined with the remainder due for release next year.

Metal-in-concentrate production was likely to be within guidance at about 4.3 million PGM ounces for 2021, it said.

For 2022, refined output has been revised down to 4.2 million to 4.6 million PGM oz as a consequence of the stock depletion and the proposed rebuild in the second half of the year of Amplats’ Polokwane smelter.

Metal in concentrate would be between 4.1 and 4.5 million oz next year partly owing to maintenance at Mogalakwena South Concentrator which is aligned to the downtime of the Polokwane smelter, said Amplats.

Metal in concentrate production in 2023 and 2024 was expected to remain flat but refined production would dip to 3.8 to 4.2 million in 2023 as Mogalakwena mined a higher proportion of base metals content which would strain smelter capacity, before recovering to 4.1 to 4.5 million oz in 2024.