NORTHAM Platinum Holdings has bid for control of Royal Bafokeng Platinum (RBPlat) announcing today a voluntary offer worth R32.5bn.

The offer, which comes a year to the day it first acquired a 34.5% beachhead in RBPlat, proposes offering R172.70 per RBPlat share. The offer consists of cash and shares but with the cash element of the offer ratcheting up the lower the acceptance.

In so doing, Northam is incentivising the balance of minority shareholders to accept its offer should rival Impala Platinum (Implats), which has built up a stake of 40.7% in RBPlat, not vend in to the offer. In other words, the offer to minorities would consist of a maximum of R152.42 in cash and R20.28 in Northam shares if Implats decides to retain its stake.

Northam acquired its 34.52% stake in RBPlat for R180.50/share. Its offer today is equal that after subtracting the value of dividends derived from its current stake in RBPlat. The offer consideration represents a 20.3% premium to the 30-day trading average of RBPlat shares as of November 8.

As a voluntary offer, which contrasts with Implats’ R150/share mandatory offer for RBPlat launched in January, the transaction is conditional on acquiring 50.1%. The long-stop date on the transaction is end-June next year although the ambition is to conclude it by the first quarter of next year.

Northam was able to trigger its voluntary offer after exercising options first acquired at the time of buying its 34.52% stake in RBPlat, giving it a current stake of 37.8%.

Key among Northam’s target shareholders will be the government-owned Public Investment Corporation (PIC) which owns just over 9% of RBPlat.

Northam firepower

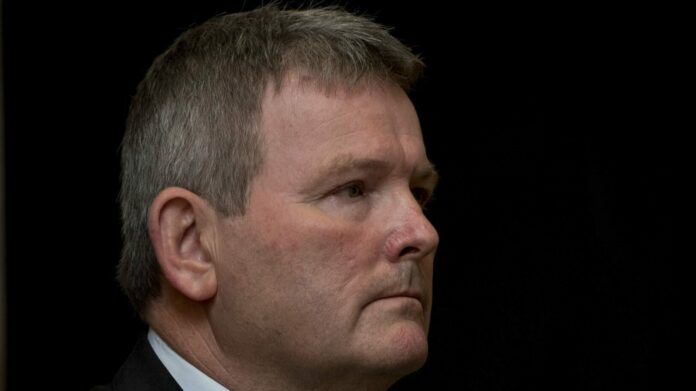

Paul Dunne, CEO of Northam Platinum said in March that he ultimately desired control of RBPlat and that he regarded the firm’s current 34.5% stake “a silver medal”. Said Dunne at the time: “There are a number of potential outcomes other than the obvious,” he said.

However, one of the criticisms is that the company’s balance sheet was not equipped to tackle the transaction having ended its 2022 financial year to June 30 with increased net debt of about R16bn. Dunne said today that the firm’s balance sheet, liquidity and credit outlook “have strengthened significantly” since then.

The company announced on October 28 that in addition to repaying the deferred cost of buying its 34.52% stake from Royal Bafokeng Holdings (RBH), it had increased its banking facilities to a total of R9.15bn. This was following agreement on a new R5bn revolving credit facility and finalisation of a loan agreement.

Given that the most Northam Platinum will have to pay out in cash is about R10bn – the cost of buying out minorities at R152,42/share representing 22% of RBPlat’s issued shares – its offer is fully financed.

This has enabled Northam to “present an offer construct to RBPlat shareholders with a compelling cash consideration and an attractive premium, whilst limiting the number of Northam shares to be issued,” said Dunne.

Northam reported a 7.6% decline in operating profit to R14.6bn for the year ended September and below consensus free cash generation of R11.4bn. Earnings before interest, tax, depreciation and amortisation slid a shade to R16.5bn compared to R16.7bn for the 2021 financial year.

Groundwork for JV

RBPlat’s assets contain an estimated 62 million ounces of platinum group metals (PGMs) consisting of UG2 and Merensky reefs at an extraction rate of about 75% – relatively high in the industry.

The deposits are also shallow ranging from surface to a depth of 1,000 metres. Dunne has long made the point that “depth is a proxy for risk and cost” in the industry. “That makes the assets very competitive and very strategic,” he said previously.

Implats has a similar view on the assets which it wants to control in order to extend the lives of several shafts of its Rustenburg Lease which is cross-boundary to RBPlat’s Bafokeng Rasimone Platinum Mine and Styldrift.

It’s for this reason that Implats may decide to retain its RBPlat stake – an outcome Northam anticipated elsewhere in its proposal today saying that it would extend the royalty arrangement between Implats and RBPlat in respect of Implats’ 6 and 20 shaft provided they were concluded “on commercially reasonable terms”.

It also committed to retaining RBPlat’s current employee complement saying it had “no intention to scale down employment at RBPlat’s operations.

Northam added there was “a good cultural fit” between itself and RBPlat’s mines. The proposed takeover would “harmonise the management” of the combined assets, it added.