AFRICAN Rainbow Minerals (ARM) has deferred the expansion of its Bokoni Platinum Mine saying in its interim results announcement on Friday it would conserve cash.

Basic earnings for the six months ended December 31 plummeted to R6.20 per share compared to restated earnings of R22.39/share for the interim stage in 2022. The decline in earnings for the period under review was, for the most part, owing to R1.74bn in impairments, predominantly of the group’s platinum group metal (PGM) assets.

The Two Rivers mine was written down by R1.1bn while a further R376m was impaired at Modikwa mine. The balance of write-downs was at Beeshoek, an iron ore mine and at Cato Ridge which produces manganese for R288m and R5m respectively.

“Due to depressed PGM commodity prices and uncertain outlook, the BFS [bankable feasibility study] project approval request has been deferred,” said ARM of Bokoni in its results commentary.

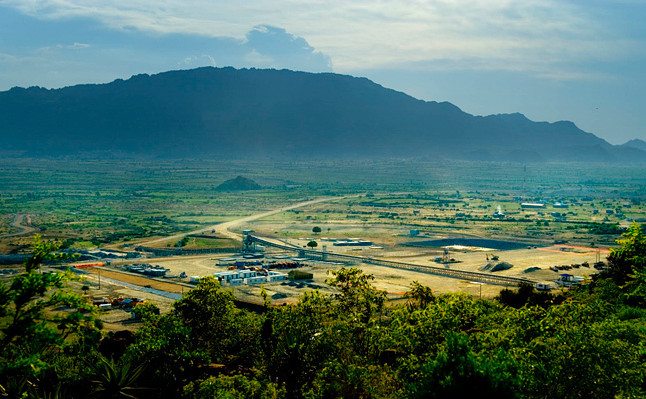

“The immediate priority will be to conserve cash while ramping up production on a phased basis, from the initial installed capacity of 60,000 tons per month by leveraging and enhancing existing infrastructure,” it said. First production from the brownfields project was achieved on schedule in November.

Bokoni was placed on care and maintenance in 2017 by then owners Anglo American Platinum (Amplats) and Atlatsa Resources. ARM bought it in December 2021 for R3.5bn and intended investing another R5.3bn to re-develop the operation.

At the time of its relaunch, Mike Schmidt, then CEO of ARM, said his company’s approach in making a success of Bokoni was to focus on mining its UG2 reef which was predominant in palladium and rhodium (57% prill split). There had been “a fundamental shift in the PGM market over the last five years to thrift to palladium and rhodium,” Schmidt said. The fact that the prill split of the UG2 reef was towards these metals “bodes well”, he added.

Since then, there has been a major correction in PGM prices with palladium and rhodium hit most heavily down 40% and 62% last year respectively. Bokoni reported a headline loss of R341m for the six months.

“Bokoni is a world class orebody that will add significant value for shareholders,” said Patrice Motsepe, executive chairperson of ARM at the group’s presentation to analysts later on Frieday. But he also acknowledged the market had changed for PGMs, a development that worried analysts.

Concerns range from funding the further expansion of Bokoni to whether it can wash its face at the current first phase of throughput. Thando Mkatshana, CEO of ARM Platinum said the current throughput was “not efficient” a the current price.

Phillip Tobias, CEO of ARM was even more outspoken. “As I’ve said before scale is key for the PGM business. [Throughput] of 60,000 tons/month is extremely sub-optimal,” he said. “At 240,000 tons/month then you’re talking good cost and good margins. But it’s a journey and we are progressing,” he said.

ARM has generally operated on a net cash basis through the years. As of December 31, it had net cash of R7.9bn compared to R9.8bn as of June 30. But funding for the scale up of Bokoni, as well as finance required to complete commissioning of the Merensky Project at Two Rivers, a mine ARM shares with Impala Platinum, would see more debt introduced to the firm’ balance sheet.

“In terms of the strategy and us still continuing to pay dividends, that hasn’t changed but over the next three to five years we will introduce some debt onto our balance sheet,” said ARM finance director Tsundzukani Mhlanga.

ARM declared an interim dividend of R6/share which compares to a payout of R14/share at the interim stage in the firm’s 2023 financial year. Last year, ARM declared a final dividend of R24/share.