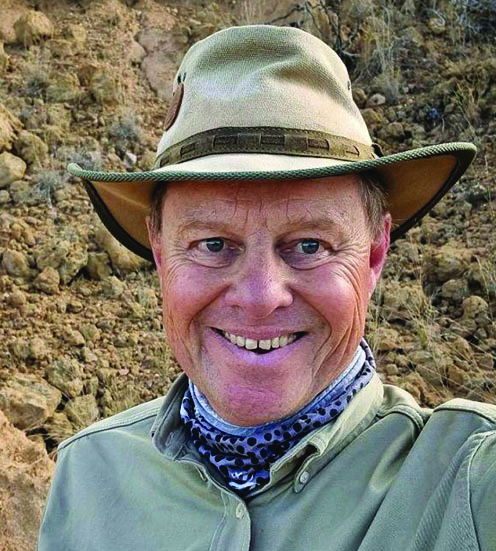

John Thornton

CHAIR: Barrick Mining

'Barrick has been very slow to say to themselves: the most important thing when you’re buying companies in the mining industry is just buy it’

NORMALLY, stepping into the shoes of a mining executive with a track record like that of Mark Bristow might be intimidating for the new appointee; but not so for interim Barrick CEO Mark Hill. That’s because he has clearly been given strict instructions from chair John Thornton to undo much of what Bristow put in place during his six years at the group. No reason was given for Bristow’s abrupt departure, but it seems Thornton was under pressure from the likes of Elliott Investment Management to tackle Barrick’s exposure to high-risk jurisdictions such as Mali and Pakistan.

There are also rumours of a personal bust-up between Thornton and Bristow. Certainly, Thornton was losing faith in the ‘Bristow Way’. The former banker said in 2024 Bristow had been too reticent to do deals. One thinks of Barrick’s opportunity to buy the Grasberg copper mine, the Freeport McMoRan asset in Indonesia. Whatever the reasons, the situation now is that Barrick has settled the long-running dispute with Mali’s government over the seized Loulo-Gounkoto mine, agreeing to pay $430m demanded by the government, which Bristow refused to do. Perhaps Barrick does not care anymore because it could get out of West Africa as part of a restructuring focused on development of its ‘safe’ North American mines.

Thornton is overseeing a potential IPO of Barrick’s North American assets into a listed subsidiary. The aim is a rerating of Barrick, but some analysts believe this will eventually lead to a merger with Barrick’s great rival, Newmont. Thornton meanwhile is overseeing the overhaul of Barrick’s board. Helen Cai has been appointed CFO, replacing Graham Shuttleworth, a longstanding Bristow ally.

LIFE OF JOHN

Thornton is viewed as a divisive figure who has a reputation for a “hard-charging” work ethic, according to the Financial Times. It is an approach he developed while at Goldman Sachs, where he was president, before leaving in 2003. Thornton joined Barrick in 2014, slashing middle managers and cutting costs before helping to craft the union with Mark Bristow’s Randgold Resources. With bachelor’s degrees from Oxford and Harvard, and a master’s from Yale, Thornton has cultivated a close relationship with China, where he serves as a professor at the elite Tsinghua University.